What is FCA Incoterms?

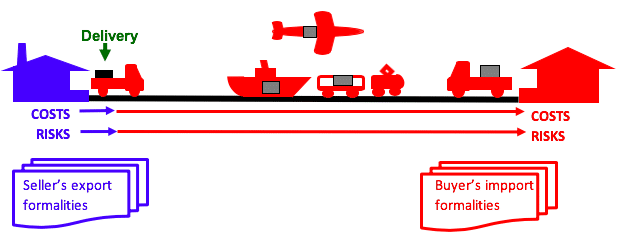

FCA is short for Free Carrier and displays one of the Incoterms that defines the level of responsibility of both the seller and the buyer in an international shipment. FCA shipping terms mean that the seller arranges goods delivery to the point mentioned (it could be his premises or a carrier’s facility specified by the buyer). The risk and costs up to the point of delivery to the carrier remain with the seller.

Once delivered, the buyer, therefore, assumes responsibility in transportation, including any additional cost and risks on the movement of the goods to their destination. The definition by Incoterms explains that the obligation of the seller is met when the goods have been delivered to the agreed location after which the buyer manages the logistics.

The FCA Incoterms meaning draws out that the term is flexible and may be used for any form of transportation. Hence, it may also be applied to different shipping situations. In such a transaction, clarity must be provided as to where delivery will be made and what type of logistics will be utilized.

What Is FCA In Shipping Terms?

Free Carrier is the Incoterm utilized in shipping to describe the various obligations of both the seller and buyer concerning the delivery of goods. In the FCA shipping terms, a seller is said to deliver merchandise to a specific location, either at premises carrier or another agreed point, at his cost and risk up to that point.

This means that the buyer will be responsible for transportation once delivery is made; this also includes any costs and risks associated with delivery. The definition of FCA by Incoterms has, however, made it clear that the seller’s obligations are considered to have been discharged upon delivery of the goods to the carrier or any other agreed place, whereby the buyer assumes control.

FCA shipping can be versatile, broadly used for any mode of transport. Being informed on what FCA means in shipping sheds light on the proportionate responsibilities developed between the buyer and seller to make sure that effective and successful transactions are made.

How Free Carrier Shipping (FCA) Works?

Free Carrier is an Incoterm versatile in international shipment where the responsibilities of parties are clearly mentioned, both for buyers and sellers. Incoterms terms under FCA specify that the seller shall undertake delivering the goods to a named location within his own country. It could be his premises, or it could be a carrier’s facility that may have means of transportation like trucks, trains, boats, or airplanes.

It entails that the cost and the risks lie with the seller on transporting the goods to the agreed point of delivery. Again, the goods are not to be unloaded by the seller; they can nevertheless be asked to clear the goods for export if the place of delivery happens to be the seller’s premises.

Once the goods are transferred to the carrier or an agreed point, responsibility and liability shift from the seller to either the buyer or the carrier. This means the buyer henceforth assumes all the subsequent costs and risks involved in transporting the goods to their final destination.

Effective communication and an express mutual agreement on the place of delivery, with any documentation being done, will ensure that customs clearance is smooth and unhindered for the shipment. This, therefore, sets out to define these terms, which will facilitate Free Carrier in international shipping and greater cooperation between the buyer and the seller.

FCA Implication: Documentation and Commercial Invoice

The seller is supposed to make and provide all the necessary documentation needed for exportation; this includes issuing bills of lading that are needed besides those regarding trade. A very important part is the commercial invoice, which is to be prepared with great precision in order for it to reflect the terms agreed upon by the buyer and seller. This is a very important invoice, both for customs clearance and payment purposes, containing all the details regarding goods sold, terms of sale, and any other agreement that the transaction may entail.

FCA Implication: Export Packing and Handling

The seller must ensure that the goods are securely packed for export. This involves the selection of packing materials that will protect the products in transit and avoid any potential damage. The packing must meet both the buyer’s requirements and could also be subject to regulatory requirements in the exporting country for smooth handling down the supply chain. Proper packing is critical for safeguarding the goods and making sure they arrive in optimal condition.

FCA Implication: Export Customs Clearance

As stated under the terms of the FCA, one of the main responsibilities of the seller is the export customs clearance. The seller must attend to all the formalities for export so that the goods can leave the country of origin legally. He has to obtain an export license, permit, and other documents to make the export conform to the requirements of the local legislation.

What are the Buyers and Sellers Responsibilities with FCA Agreements?

The FCA agreement is fully comprehended at Topshipping to be an ingredient in the smooth shipment of goods internationally. This Incoterm spells out clear responsibilities between buyers and sellers to ensure efficient logistics.

FCA provides that under the contract, the place of delivery by the seller is either his premises or even the carriers’ premises. The seller has to bear all costs and risks concerning the transport of goods up to the point where the goods will be handed over to the main carrier. It also includes correct packaging and necessary documentation for transport.

The buyer’s responsibility starts from the time the goods are delivered to the carrier, including transportation cost management with associated risks, customs clearance at destination, and instructing the carrier with subsequent logistics.

It is interpreted herein as being articulate and putting a clear agreement on the delivery points and terms that eliminate misunderstanding and holdups in delivery. We at Topshipping address the importance of those very details with a view to ensuring smooth processing of shipping and successful transaction across the two parties concerned.

FCA Tips And Tricks

Where the named place in FCA terms is a forwarder’s warehouse or a terminal and not a seaport or airport, a seller remains responsible for loading the truck at their premises. A carrier then has the responsibility of unloading at named place. It follows, therefore, that the buyer assumes some responsibilities in an export country such as transportation and terminal charges.

If the named place is the supplier’s factory, then the arrangement very closely resembles EXW (Ex Works) . The main difference indeed lies in the fact that, in FCA, the supplier has an obligation to load the truck. Again, the buyer also undertakes responsibility for transportation and terminal charges in the export country.

Regardless of the named place, the seller is responsible for all export-related tasks and documentation. In letter of credit payments -type transactions, the buyer can ask the carrier to insert the word “aboard” on the Bill of Lading.

FCA Freight Terms

FCA freight terms define the responsibilities of either of the parties, whether it is a seller or a buyer, in the case of shipment. In FCA, the seller delivers goods to a named place at his cost and risk up to that point. The seller must take care of export clearance. At the point of delivery, the buyer undertakes responsibility for transportation and insurance and payment of import duties. This can be used to attain flexibility for any mode of transport. Summary: FCA gives a clear demarcation of responsibilities wherein either party would know very well their duties regarding shipment.

Example of FCA Incoterms

Suppose this seller produces electronic components and, upon agreement, is supposed to deliver such goods to our transport facility. An FCA agreement would state that the seller bears all costs and risks of transporting goods that are addressed to us at their location. This also includes suitable packaging of the goods and provision of necessary documents.

Upon the supplier delivering merchandise to our facility, his responsibility with respect to shipment would be ended. That’s when Topshipping comes into play. We assume responsibility of shipment from our facility to the final destination of the buyer by assuming all costs and risks of shipping thereafter.

In fact, good communication on the delivery schedule and all the documents that would be required for delivery has to be continued well for a smooth transition and successful delivery. We do this in the effort to facilitate logistics more smoothly and effectively, increasing accountability so that you and your buyer experience as smooth a shipping process as possible.

If you have any other questions, please don’t hesitate to contact us at Topshipping. That is what we are here for-to help make your shipping process as streamlined and smooth as possible.

Advantages and Disadvantages for the Buyer

Buyer’s Benefits

Control of Transportation:

The buyer can have control over transportation in that he selects a carrier and undertakes logistics onward from the named place of delivery.

Economies in Transport Cost:

So long as the seller delivers the goods to the named place, the buyer may realize economies in transport costs by enjoying better shipping rates or more efficient logistics.

Flexibility:

Buyers can tailor transportation to their needs and maybe capture customized cost-effective shipping solutions.

Buyer’s Disadvantages

Risk of Loss or Damage:

The loss or damage from the named place shall be borne by the buyer.

Financial costs attached with such incidents are to be borne.

Import formalities are complex and may involve a lot of time; these have to be dealt with by the buyer, especially when there are customs formalities to be observed.

Other Costs:

Import clearance beyond the named place and other costs are likely to add to overall cost of the transaction.

Dependency on the Seller:

In most cases, buyers depend on the seller to properly prepare merchandise for delivery to an agreed-upon place; failure to take up responsibilities on his part often leads to delays or problems.

All in all, though FCA terms present buyer benefits regarding control of transportation and possible savings, they also involve risks and responsibilities that are taken seriously.

When to Use an FCA Agreement?

FCA, or Free Carrier, can be applied in any FCA agreement when one is a transport company that wants to clearly detail what one expects from a seller and from a buyer in the process of shipment. This Incoterm would be ideal when goods are delivered to your facility or another carrier’s location by the seller.

FCA comes in handy when you have in place the logistics capabilities to undertake the next leg of transportation. The seller’s task is now relegated to bringing goods to your facility, where you arrange for the onward shipping to the buyer. FCA thus becomes quite useful in international trade, where one has to clearly document the responsibility for costs and risks. This clears up many misunderstandings and provides for smooth operations along the entire supply chain, adding efficiency and accountability to all parties involved.

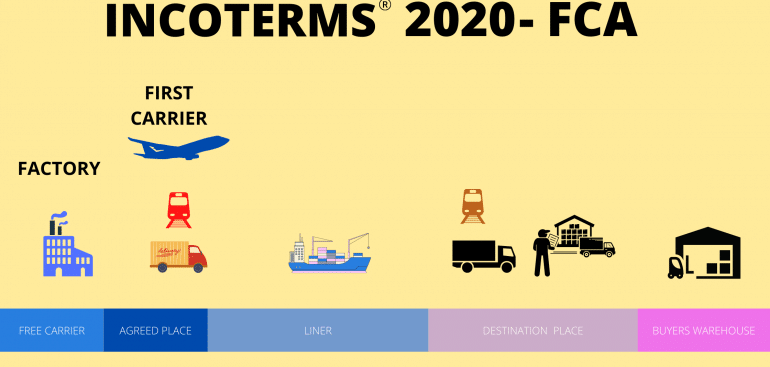

FCA Incoterms 2020

FCA Incoterms 2020 forms one of the rules developed by the International Chamber of Commerce that clearly explains the different responsibilities in an international trade transaction between two parties: a buyer and a seller.

In agreement with the terms FCA 2020, the seller is obligated to deliver the goods to a carrier or another party nominated by the buyer at a specified location.

It may be the seller’s premises or any other place that may be agreed upon, such as a freight terminal, port, or warehouse; it is called the “named place of delivery.”.

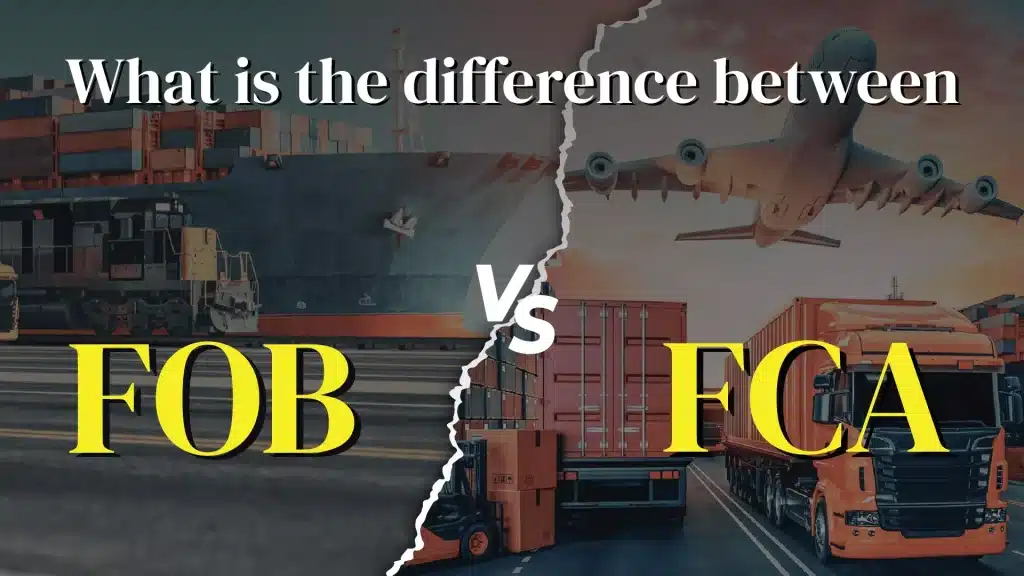

What Is the Difference Between FCA and FOB?

FCA and FOB (Free On Board) are Incoterms, that is to say, standard sets of trading terms used mainly but not exclusively in international trade. Under the FCA, the seller is obliged to deliver goods to a particular place, normally a carrier or terminal, with costs and risks transferable to that extent. The risk would then pass to the buyer at this point, who pays the cost of loading and shipment.

Contrarily, FOB means the seller is to deliver the goods to the ship’s side at the port of shipment, bearing the costs and risks prior to the time the goods have been so loaded on vessel. Then, after going on board, the responsibility passes to the buyer. In other words, FCA can be used with any mode of transport, but FOB is used for maritime transport only, pointing to variable transfer points of risk between buyer and seller.

What Is the Difference Between FCA and DDP?

FCA and DDP (Delivered Duty Paid) are both Incoterms, which refer to the explanation of the responsibility of buyers and sellers in international trade. In FCA, the seller delivers the goods at the place specified to the carrier mentioned, bearing the cost and risk only up to that point. Thereafter, the buyer would take over responsibility for transportation and any other additional costs beyond that place.

On the other hand, DDP places the maximum responsibility upon the seller. Here, the seller is required to deliver the goods not only to the location of the buyer but pays all the costs incurred on freight, insurance, and import duties. The responsibility of the buyer only arises when delivery is provided. In essence, FCA is more flexible and partly passes on the risk to the buyer, whereas DDP ensures that all aspects pertaining to delivery and expenses occurring for the delivery of goods shall be taken care of by the seller in order to provide hassle-free service to the buyer.

What are the differences between Free Carrier and Ex Works?

Free Carrier , or Ex Works-EXW, are Incoterms that detail the responsibilities of sellers and buyers in an international trade deal. FCA binds the seller to deliver the goods to a designated carrier or location and to handle export clearance and any connected costs to that point. Once delivered, it is the buyer’s responsibility to take charge of transportation and import duties.

The closest to the opposite is Ex Works, under which the liability of the seller is at a minimum. Under it, the seller is obliged to only make the goods available at his premises. From there on, transportation, customs, and export procedures all fall under the responsibility of the buyer. FCA, in easy words, supports the buyer with initial transport, while EXW requires the buyer to handle everything from the seller’s site.

Who pays for FCA in shipping?

In the FCA shipping terms , the seller is responsible for the arrangements and costs concerning the carrying of the goods to the named place agreed upon with the buyer. In light of this, it implies that the seller bears all the charges incurred on carrying the goods from their premises or another named address to the stated delivery point.

Nevertheless, under the terms of FCA, while the seller pays the cost of transportation to the named place of delivery, any further cost of transport beyond that is at the risk of the buyer.

The buyer has to attend to all import clearance formalities, duties, taxes, or other levies beyond the delivery to the named place.

Consequently, to address your question directly, the FCA Incoterms shipping charges up to a contractually agreed place of delivery are to be borne by the seller.

Who Is Responsible for Export Clearance Under FCA?

Under FCA , the seller is responsible for export clearance. This means the seller must handle all necessary customs procedures and documentation needed to export the goods from their country. The seller bears the costs and risks associated with this process until the goods are delivered to the agreed-upon location or carrier. Once the goods are handed over, the responsibility shifts to the buyer, who then manages the transportation and import clearance in the destination country. Therefore, while the seller ensures compliance with export regulations, the buyer takes on further responsibilities once the goods are in transit.

The Bottom Line

Under FCA shipping terms, the seller provides pre-carriage to a terminal, delivery to the agreed location, and proof of delivery. He arranges export packaging, licences as well as customs formalities.

On the other hand, the buyer pays for the goods, main carriage, and loading. The importation-related duties, taxes, and customs formalities are also paid by the buyer.

The Freight Forwarders assist in logistics management right from the point of delivery by the seller to the destination of the buyer, ensuring that the transport is efficiently undertaken with conformation to FCA terms.

At TopShipping Company , we coordinate with a freight forwarder so that your shipping process for FCA is as smooth as possible.

Questions and Answers About FCA tearns:

Under FCA terms, if the seller’s place of business is also the named place of delivery, the seller must load the goods onto the buyer’s incoming transport. However, when the named place of delivery is somewhere other than the seller’s place of business, such as a freight terminal or port, the seller need only make the goods available for pick-up there and is not obliged to load them.

FCA terms of delivery mean the risk and cost of transportation of the goods shall pass on to the buyer when the goods are delivered into the care of the carrier or another party nominated by the buyer at the agreed place. From then on, the buyer bears every risk and cost in regard to the goods.

Yes, FCA Incoterms can be applied in all modes of transportation: by road, rail, air, or sea. The delivery term is flexible because the parties can show a place of delivery that would suit them best for their logistics needs.

Under the FCA terms, the seller will effect export clearance and obtain any export licenses as well as pay for any duties/fees levied on export. On the other hand, import clearance, which includes obtaining an import license and paying duties and taxes in the country of destination, shall rest with the buyer.

I appreciate the breakdown of FCA Incoterms. Knowing when risk and cost transfer is so important in trade negotiations.