Introduction

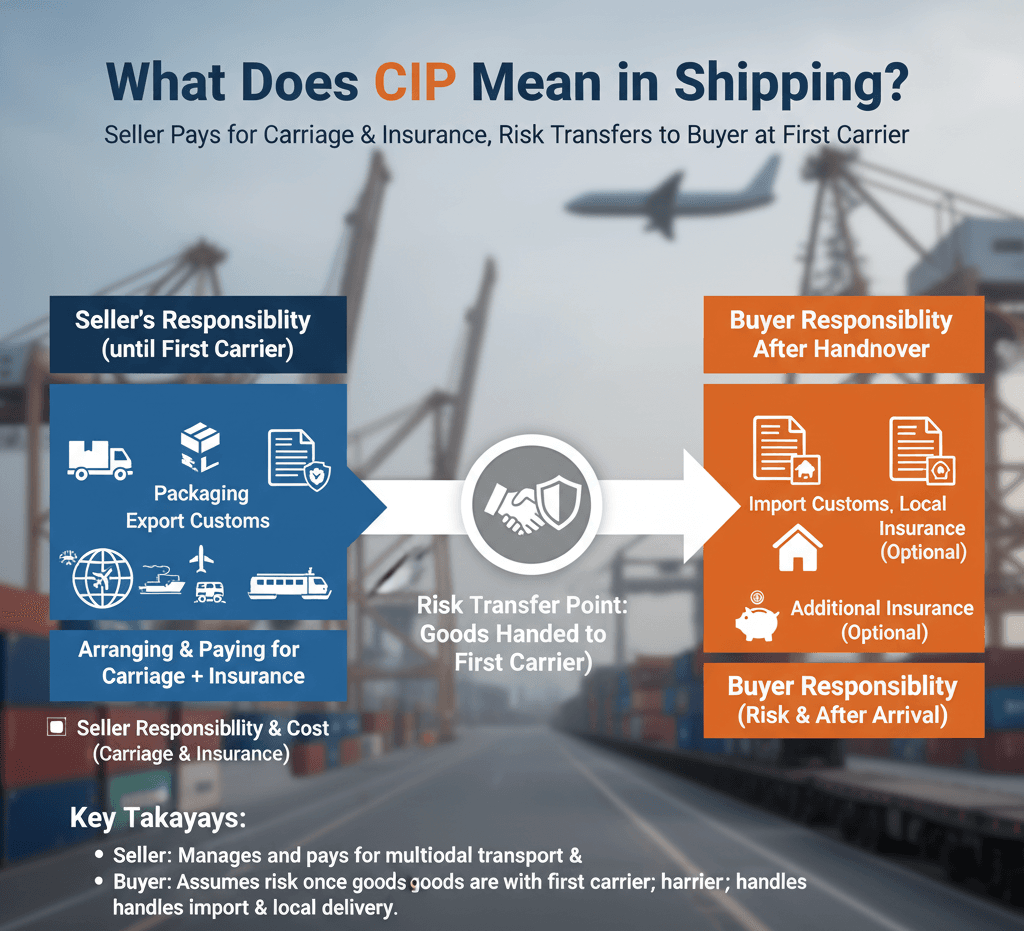

In international shipping, CIP (Carriage and Insurance Paid To) is one of the most practical Incoterms for global trade.

Under CIP shipping terms, the seller is responsible for arranging transportation and insurance coverage up to the agreed destination.

The buyer assumes risk once the goods are handed over to the first carrier, but benefits from seller-arranged freight and insurance.

This balance makes CIP ideal for businesses that want security during transit while maintaining control over import clearance and local delivery.

In this article, we’ll explain CIP shipping meaning, outline seller and buyer obligations, clarify how insurance works, and compare CIP Incoterms vs CIF (Cost, Insurance and Freight)to help importers and exporters choose the right shipping terms for their international operations.

What Does CIP Mean in Shipping?

CIP stands for “Carriage and Insurance Paid To”, one of the most versatile Incoterms used in international trade.

Under CIP shipping, the seller is responsible for arranging and paying for the carriage (transportation) of goods to a named destination, as well as providing insurance coverage during transit.

In simpler terms, the seller takes care of shipping and insurance costs until the goods reach the agreed destination, while the risk transfers to the buyer once the goods are handed over to the first carrier.

This makes CIP Incoterms ideal for multimodal transport (Road Freight , Air Freight, Rail fright, or Sea Freight), offering flexibility and protection for both parties. It’s commonly used when buyers want convenience and assurance that their cargo is insured throughout the main carriage.

CIP Incoterms 2020 Rules and Updates

Under the CIP Incoterms 2020 rules, the main change introduced by the International Chamber of Commerce (ICC) was the requirement for higher insurance coverage compared to previous versions.

According to the 2020 update:

- The seller must now provide insurance coverage equivalent to Institute Cargo Clauses (A) the maximum level of protection unless otherwise agreed in the contract.

- This ensures the buyer receives broader coverage against potential risks during international transit.

The CIP term continues to apply to all modes of transport, making it more flexible than terms like CIF, which are restricted to sea or inland waterway transport.

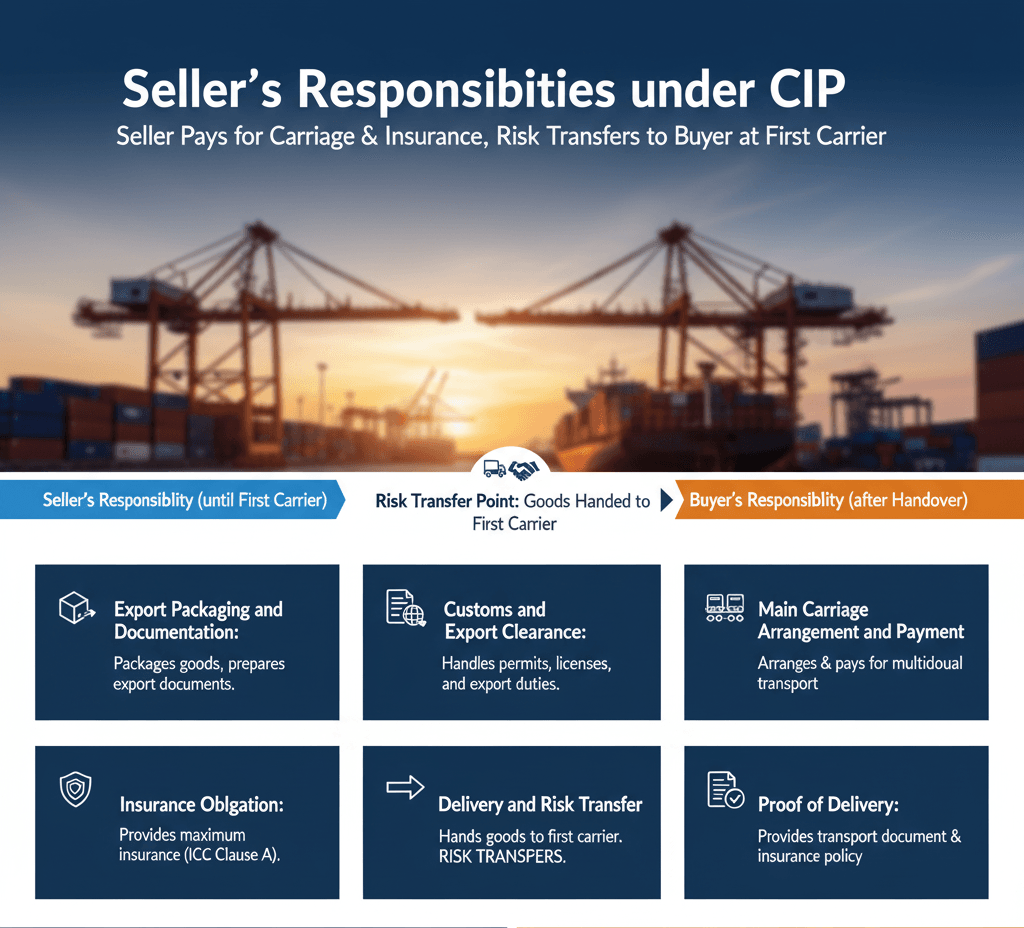

Seller’s Responsibilities under CIP

Under CIP Incoterms (Carriage and Insurance Paid To), the seller carries significant obligations designed to ensure the goods are properly prepared, insured, and transported to the named destination. This term provides a high level of buyer protection but demands careful compliance from the seller at every stage.

Here’s a detailed breakdown of the seller’s key responsibilities:

Export Packaging and Documentation:

The seller must properly package the goods according to the nature of the cargo and transport method.

They are also responsible for preparing and providing all export documentation, such as the commercial invoice, packing list, export license, and any other certificates required for customs clearance in the origin country.

Customs and Export Clearance:

The seller handles all export formalities, including obtaining necessary permits, licenses, and security checks, and pays any export duties or taxes required to legally ship the goods out of the country.

Main Carriage Arrangement and Payment:

The seller must arrange and pay for transportation to the named destination agreed upon in the contract.

This can include multimodal shipping (e.g., truck + air + sea) depending on the delivery route. The seller must also choose reliable carriers and routes that ensure timely and secure delivery.

Insurance Obligation:

One of the most distinctive features of CIP is the seller’s mandatory insurance responsibility. Under CIP 2020, the seller must provide maximum insurance coverage (equivalent to Institute Cargo Clauses (A)) for the benefit of the buyer. This insurance must cover the goods from the point of delivery to the named destination, protecting against loss or damage during transit.

Delivery and Risk Transfer:

The point of risk transfer occurs when the seller hands over the goods to the first carrier, not when they reach the final destination. From that point onward, the buyer bears all risks, even though the seller continues to pay for freight and insurance.

Proof of Delivery:

The seller must provide the transport document (such as an air waybill, bill of lading, or CMR consignment note) and the insurance certificate or policy, enabling the buyer to claim insurance or take possession of the goods upon arrival.

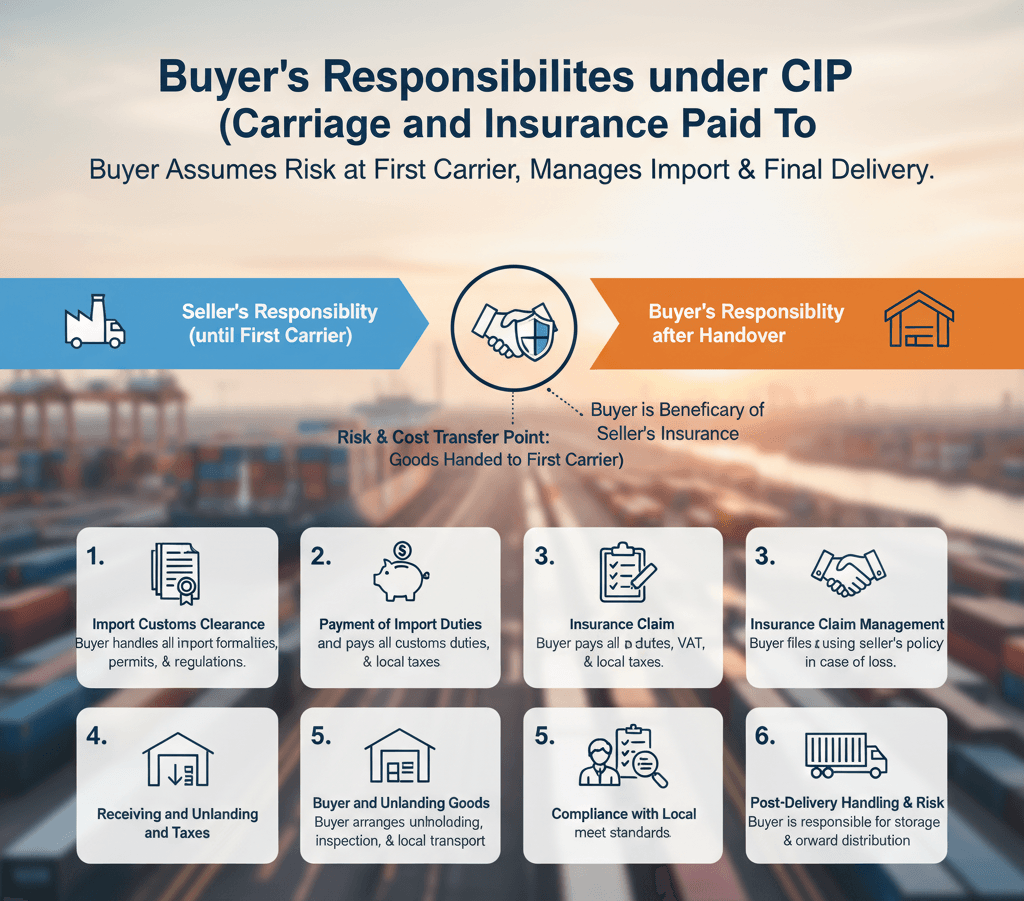

Buyer’s Responsibilities under CIP

Under CIP Incoterms, the buyer takes on several important responsibilities once the seller has fulfilled their delivery and insurance obligations. Although the seller pays for transportation and insurance up to the named destination, the buyer still assumes risk earlier in the process right after the goods are handed to the first carrier. Therefore, the buyer must be prepared to manage import procedures and post-delivery obligations efficiently.

Here’s a detailed breakdown of the buyer’s main responsibilities under CIP:

Import Customs Clearance:

The buyer is fully responsible for import clearance in the destination country.

This includes preparing and submitting import documentation, securing necessary permits, and paying all related customs duties, taxes, and import tariffs. The buyer also ensures that the goods comply with local regulations and safety standards.

Payment of Import Duties and Taxes:

After the goods arrive at the destination port or terminal, the buyer must pay all import duties, VAT, and other government charges before taking delivery of the goods.

These costs are not included in the seller’s responsibility under CIP.

Receiving and Unloading the Goods:

Once the shipment reaches the named destination, the buyer arranges for unloading, inland transport, and final delivery to their warehouse or facility.

These post-delivery costs and risks are entirely the buyer’s responsibility.

Insurance Claim Management (if needed):

Even though the seller arranges insurance, the buyer is the beneficiary. In case of loss or damage during transit, the buyer must file the insurance claim using the policy or certificate provided by the seller.

Post Delivery Handling and Risk:

After the goods are delivered to the destination terminal or point named in the contract, the buyer bears all further risks and expenses, including storage, handling, or domestic transport.

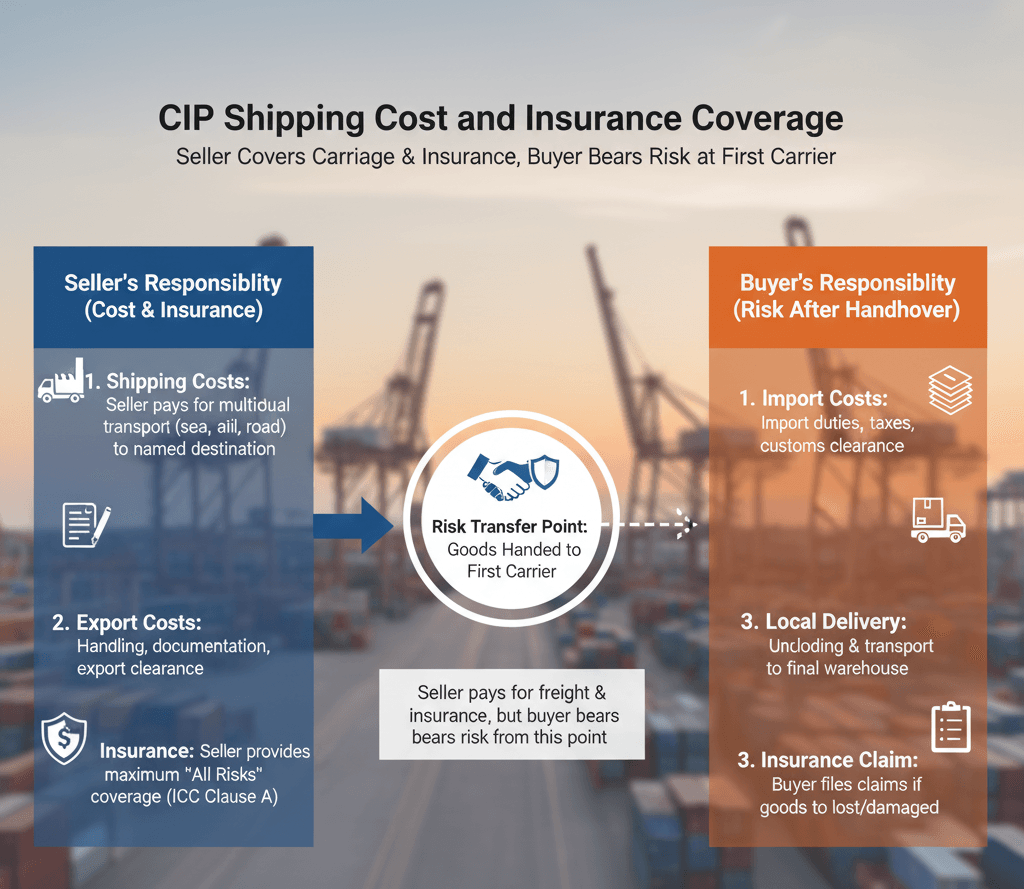

CIP Shipping Cost and Insurance Coverage

Under CIP (Carriage and Insurance Paid To) Incoterms, the seller and buyer share shipping and insurance responsibilities in a clearly defined way. This structure helps reduce disputes and ensures that both parties understand their financial and risk-related obligations during international transport.

Here’s how it works:

Who Pays for Shipping:

The seller pays for the main carriage the cost of transporting goods from the point of origin to the named destination (for example, a port, airport, or logistics terminal). This can include multiple transport modes such as sea, air, rail, or road. The seller also covers all export-related costs, such as handling, documentation, and export clearance.

Who Pays for Insurance:

The seller is also responsible for arranging and paying for cargo insurance that covers the buyer’s risk during the main transport. Under CIP Incoterms 2020, this insurance must meet the Institute Cargo Clauses (A) standard the broadest form of coverage protecting against most risks of loss or damage in transit.

Buyer’s Role in Costs:

While the seller covers transport and insurance, the buyer must pay for import duties, customs clearance, local delivery, and unloading once the goods arrive at the named destination.

How Insurance Works:

Although the seller arranges the insurance, the insurance policy benefits the buyer. If goods are damaged or lost during transport, the buyer can file a claim directly using the insurance certificate provided by the seller.

Key Point Risk vs. Cost:

Even though the seller pays for both freight and insurance, risk transfers to the buyer the moment the goods are handed over to the first carrier, not upon delivery to the destination.

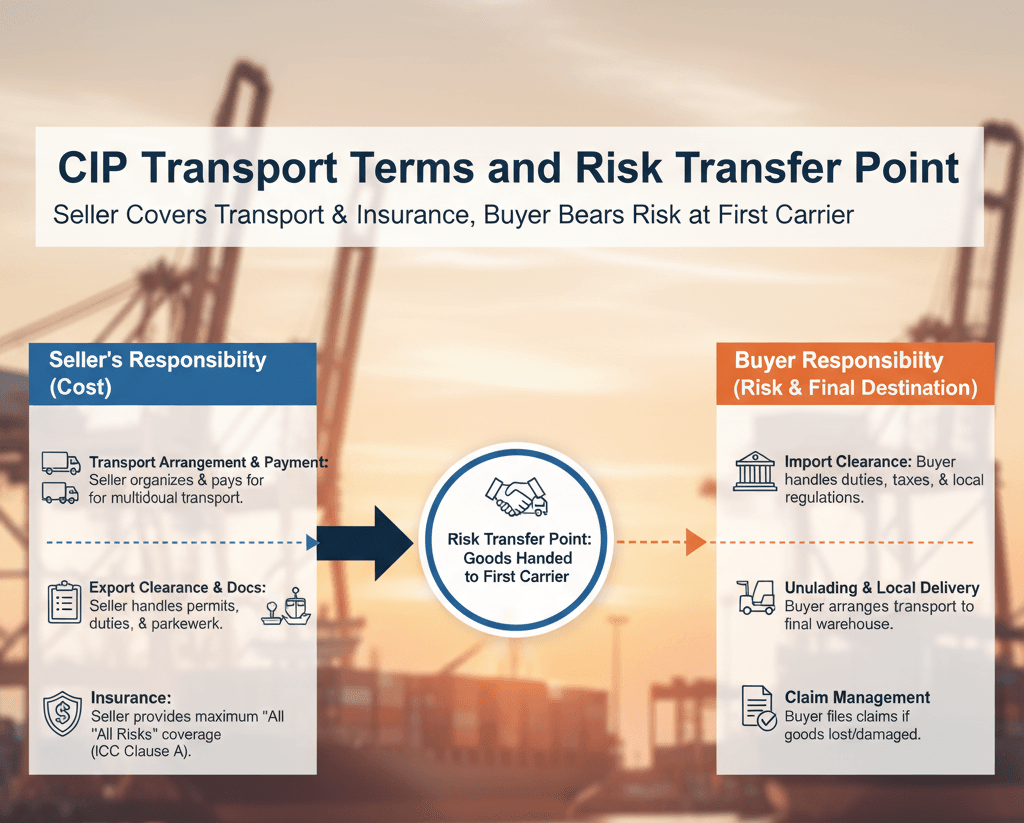

CIP Transport Terms and Risk Transfer Point

Under CIP (Carriage and Insurance Paid To) Incoterms, the division between transport responsibility, cost, and risk is one of the most important aspects to understand.

This rule applies to all modes of transport road, rail, air, sea, or a combination making it a flexible choice for international trade.

Here’s a detailed breakdown of how transport and risk transfer work under CIP:

Transport Arrangements:

The seller is responsible for organizing and paying for transportation of the goods from their premises to the named destination specified in the contract. This includes choosing reliable carriers, booking space, and ensuring timely shipment. The seller may use multimodal transport, such as combining truck and air freight, depending on the route and delivery requirements.

Delivery and Risk Transfer Point:

A key feature of CIP is that the risk transfers from the seller to the buyer once the goods are handed over to the first carrier, not when they reach the destination. This means if the goods are damaged or lost after leaving the seller’s control, the buyer bears the risk, even though the seller continues to pay for freight and insurance.

Main Carriage and Destination:

The seller pays all transport costs up to the named destination (for example, “CIP New York” or “CIP Hamburg”), covering export clearance, freight, and insurance. However, once delivery to the first carrier occurs, the buyer becomes responsible for any risks during transit.

Insurance as Risk Protection:

Because the buyer carries risk during transport, the seller must purchase cargo insurance under Institute Cargo Clauses (A) the highest level of protection to ensure the buyer’s goods are covered if an accident occurs en route.

Practical Example:

Suppose goods are sold under CIP Los Angeles (Air Freight). The seller pays for export clearance, air transport, and insurance to Los Angeles. However, once the goods are handed to the airline at the origin airport, the risk shifts to the buyer, even though the seller still pays the transport and insurance costs.

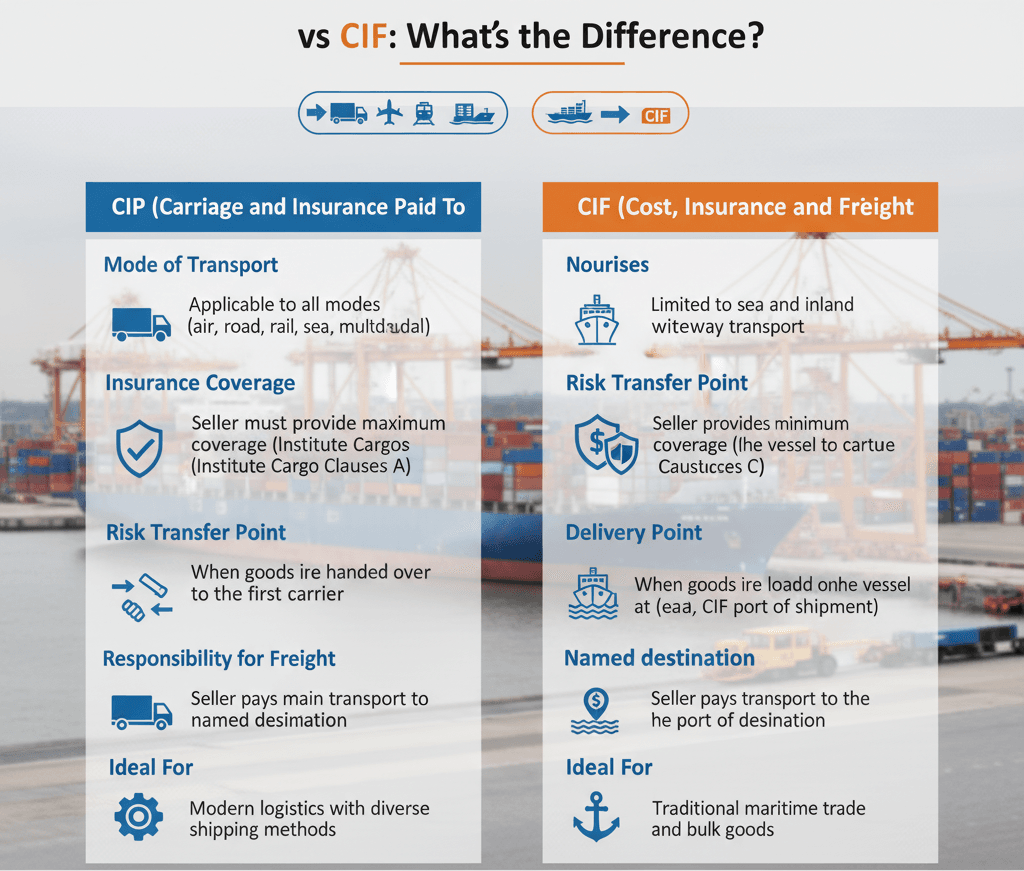

CIP vs CIF: What’s the Difference?

While CIP (Carriage and Insurance Paid To) and CIF (Cost, Insurance and Freight) may seem similar, they have important distinctions in terms of transport mode, insurance coverage, and risk transfer. Both terms require the seller to pay for freight and insurance, but the rules differ in scope and application.

| Aspect | CIP (Carriage and Insurance Paid To) | CIF (Cost, Insurance and Freight) |

|---|---|---|

| Mode of Transport | Applicable to all modes (air, road, rail, sea, multimodal) | Limited to sea and inland waterway transport |

| Insurance Coverage | Seller must provide maximum coverage (Institute Cargo Clauses A) | Seller provides minimum coverage (Institute Cargo Clauses C) |

| Risk Transfer Point | When goods are handed over to the first carrier | When goods are loaded onto the vessel at the port of shipment |

| Delivery Point | Named destination (e.g., CIP New York) | Port of destination (e.g., CIF Shanghai Port) |

| Responsibility for Freight | Seller pays main transport to named destination | Seller pays transport to the port of destination |

| Flexibility | Suitable for multimodal and containerized shipments | Best for bulk sea freight shipments |

| Ideal For | Modern logistics with diverse shipping methods | Traditional maritime trade and bulk goods |

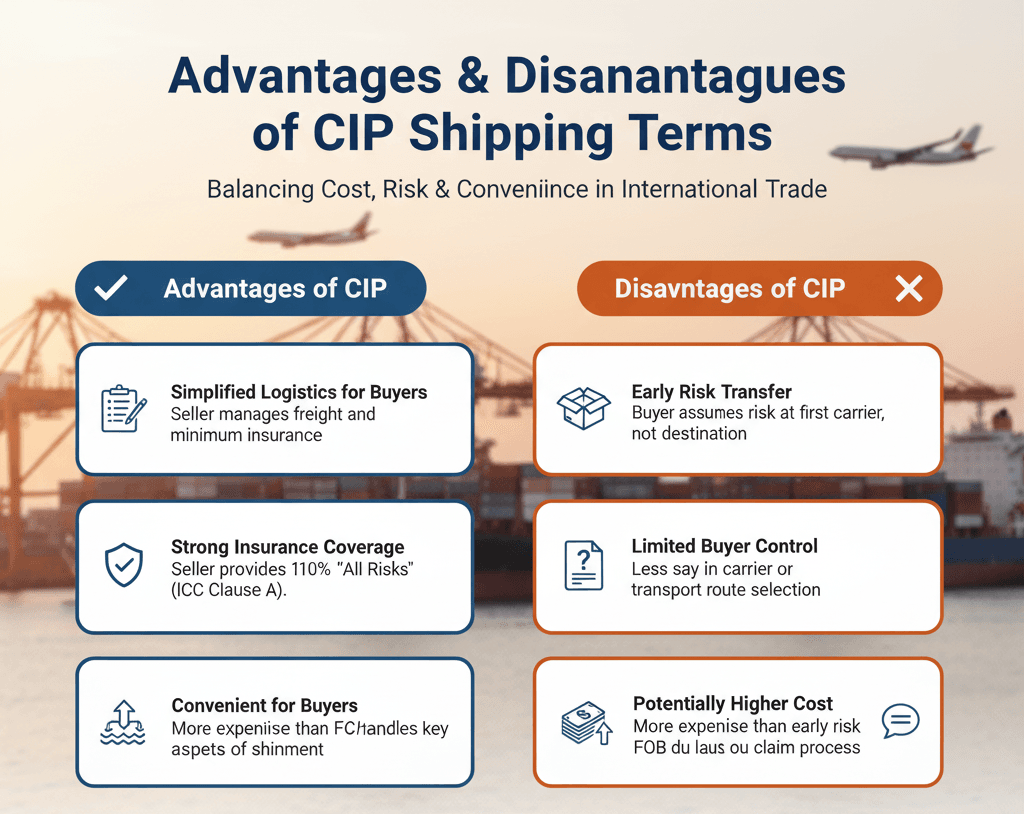

Advantages & Disadvantages of CIP Shipping Terms

CIP (Carriage and Insurance Paid To) Incoterms provide a clear framework for international shipments, balancing seller responsibilities and buyer protection.

While CIP ensures that the seller arranges and pays for both transportation and insurance, it also defines the point of risk transfer and buyer obligations at the destination.

The following table summarizes the key advantages and potential disadvantages of using CIP in global trade, helping businesses make informed decisions about shipping strategies.

| Advantages of CIP | Disadvantages of CIP |

|---|---|

| Seller arranges and pays for both transportation and insurance, reducing buyer’s workload. | Buyer still bears risk once goods are handed over to the carrier, even though seller pays insurance. |

| Provides strong insurance coverage for the buyer under CIP 2020 (110% ICC A or similar). | Insurance may not fully cover all types of losses depending on policy conditions. |

| Suitable for multimodal transport, allowing flexibility in logistics arrangements. | Buyer may have limited control over the choice of carrier and transport route. |

| Ideal for international transactions where the buyer prefers a seller-managed shipment. | Can be more expensive than terms like FCA (Free Carrier) or FOB (Free on Board) due to added insurance and freight costs. |

| Reduces administrative burden for buyers unfamiliar with export procedures. | Disputes may arise if damage occurs during transit before risk officially transfers. |

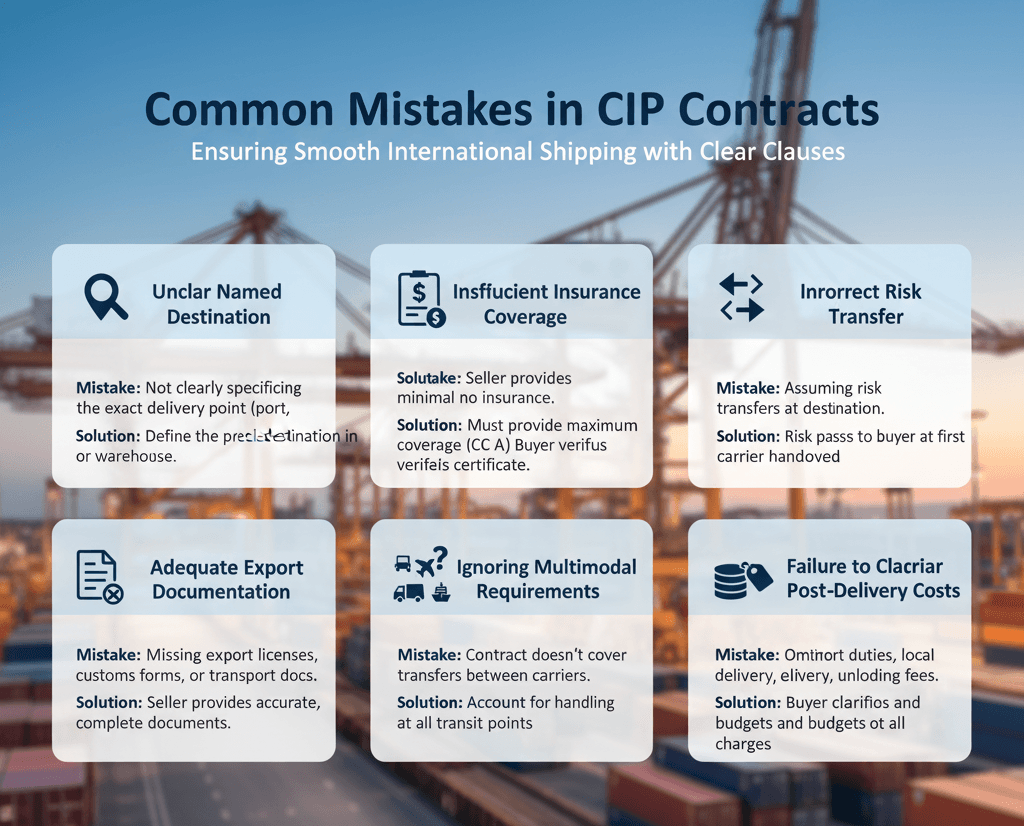

Common Mistakes in CIP Contracts

CIP (Carriage and Insurance Paid To) Incoterms simplify international shipping, but mismanagement or misunderstandings in contracts can lead to delays, disputes, and financial loss. Here are the most frequent mistakes businesses make and how to avoid them:

Unclear Named Destination:

Failing to specify the exact delivery point (e.g., port, terminal, or warehouse) can create confusion about where risk and insurance responsibilities apply. Always clearly define the destination in the contract.

Insufficient Insurance Coverage:

Some sellers provide only minimal insurance or omit it altogether. Under CIP 2020, the seller must provide full insurance coverage (Institute Cargo Clauses A). Buyers should verify insurance certificates before shipment.

Incorrect Risk Transfer Understanding:

Risk transfers when goods are handed to the first carrier, not at the final destination. Misunderstanding this can lead to disputes over damage or loss during transit.

Inadequate Export Documentation:

Sellers sometimes fail to provide proper documentation like export licenses, customs forms, or transport documents, delaying shipment or causing customs issues.

Ignoring Multimodal Transport Requirements:

CIP allows all transport modes, but contracts may not account for handling at transfer points or carrier changes, resulting in unanticipated costs or delays.

Failure to Clarify Post-Delivery Costs:

Buyers must cover import duties, local delivery, and unloading. Omitting these details in the contract can create unexpected financial burdens.

Practical CIP Example (With Numbers)

Scenario:

A company in Shanghai, China sells electronic equipment to a buyer in New York, USA under CIP (Carriage and Insurance Paid To) New York terms. Under this agreement, the seller arranges and pays for both freight and insurance for shipping from China to the US up to the named destination.

The seller is responsible for packaging the electronics, obtaining export documentation, and ensuring safe transport to the port of shipment in Shanghai. Once the goods are handed over to the carrier, the seller’s responsibility for cost ends, although insurance coverage remains in place during transit.

The US buyer assumes risk upon delivery at the destination and handles import customs clearance, duties, and inland transportation from the Port of New York to their warehouse. This setup simplifies shipping from China to the US for the buyer while providing security through seller-arranged insurance

Step 1: Seller Costs

- Product cost: $50,000

- Export packaging: $1,000

- Freight to New York: $5,000

- Insurance (Institute Cargo Clauses A): $500

Total Seller Cost: $56,500

Step 2: Buyer Costs

- Import duty (5% of product cost): $2,500

- Customs clearance and local handling: $1,000

- Inland transport to warehouse: $500

Total Buyer Cost: $4,000

Step 3: Risk Transfer

Risk transfers once goods are handed over to the first carrier in Shanghai, even though the seller pays for freight and insurance to New York.

If goods are damaged during transit, the buyer can claim against the insurance provided by the seller.

Step 4: Summary

| Party | Costs Covered | Risk Point | Notes |

|---|---|---|---|

| Seller | Product, packaging, export, freight, insurance | Handover to first carrier | Ensures goods are transported and insured to New York |

| Buyer | Import duties, customs clearance, local transport | After handover to first carrier | Responsible for clearance and receiving goods |

Key Takeaways:

- Seller ensures shipping and insurance; buyer assumes risk after first carrier.

- CIP provides clarity on responsibilities but requires careful contract definition.

- Proper insurance protects the buyer against transit losses.

Final Thoughts

Understanding CIP (Carriage and Insurance Paid To) is crucial for anyone engaged in international trade, particularly when shipments involve multimodal transport.

CIP strikes a balance between seller-managed logistics and buyer protection by clearly defining who pays for transportation and insurance and specifying the point at which risk transfers.

This clarity helps prevent misunderstandings and disputes between trading partners.

When applying CIP, considering the shipping routes and selecting the appropriate shipping methods is essential.

Proper route planning and transport mode selection ensure that freight costs remain efficient, while comprehensive insurance safeguards the buyer’s goods during transit.

For businesses seeking predictability, security, and efficiency in global shipments, CIP offers a flexible framework suitable for diverse transport scenarios.

However, both buyers and sellers should carefully review contract terms, insurance coverage, and logistics arrangements to maximize protection and ensure smooth operations.

FAQ CIP incoterm

Which is better, CIP or DAP?

CIP is better when the seller handles transport and insurance, while DAP suits buyers who prefer managing import and customs duties themselves.

Does CIP include tariffs?

No, CIP does not include tariffs, duties, or taxes these are paid by the buyer.

What is the difference between CIP and CIF?

CIP applies to all transport modes and includes insurance up to delivery, while CIF is only for sea freight and covers insurance until the port of destination.

Can CIP be used for road transport?

Yes, CIP can be used for any mode of transport, including road, air, and sea.

Who pays for CIP?

The seller pays for transportation and insurance up to the agreed destination, while the buyer covers import duties and local charges.

Who is responsible for paying duties and taxes?

The buyer is responsible for paying all import duties, taxes, and customs clearance fees under CIP.

What is the responsibility of the CIP seller?

The seller must arrange and pay for shipping, insurance, and export clearance up to the named destination.

What is the difference between FOB and CIP?

In FOB, risk transfers at the port of shipment, and insurance isn’t required; in CIP, the seller covers transport and insurance to the destination.

What does CIP mean for shipping?

CIP (Carriage and Insurance Paid To) means the seller delivers goods insured and transported to the agreed destination, with risk passing once handed to the carrier.