Introduction

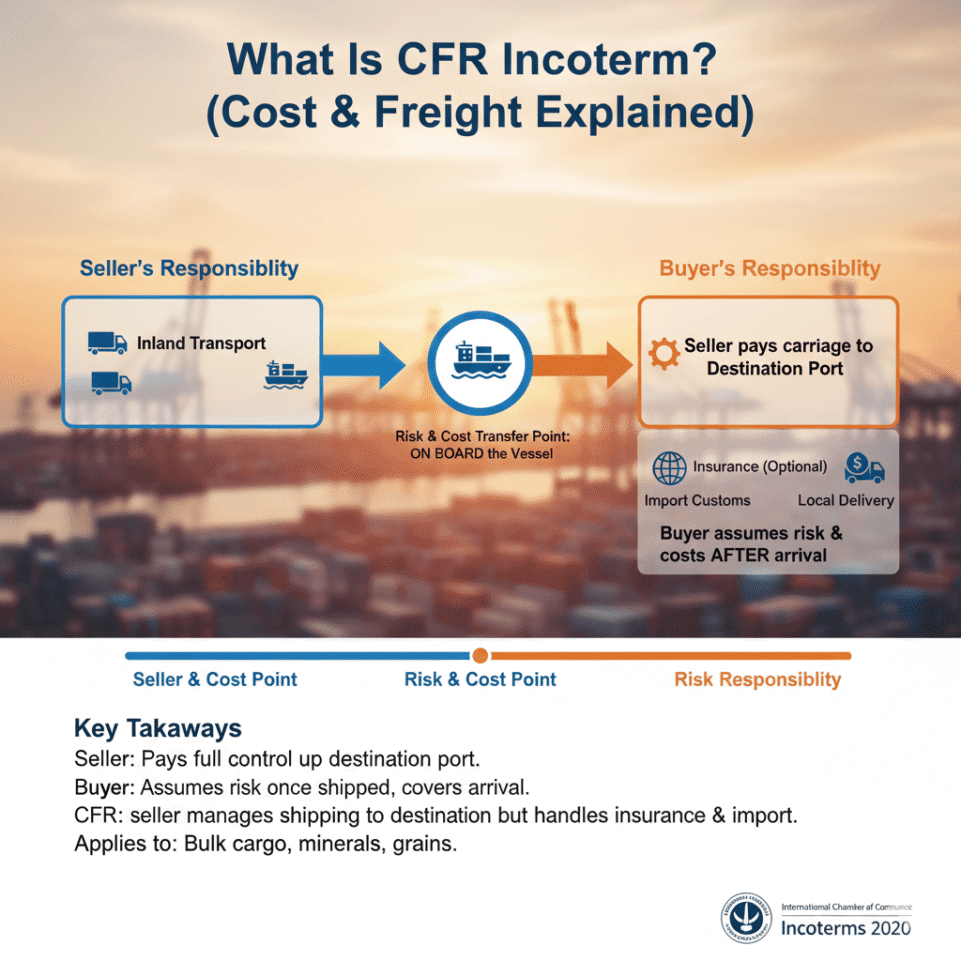

In global trade, understanding Incoterms is essential for avoiding confusion and ensuring smooth transactions between buyers and sellers. One of the most commonly used shipping terms is CFR Incoterm (Cost and Freight). Under this rule, the seller takes responsibility for arranging and paying the costs of transporting goods to the destination port. However, the risk transfers to the buyer once the goods are loaded onto the vessel at the port of origin.

CFR is widely used in sea and inland waterway transport, especially for bulk cargo such as raw materials or large shipments. By clearly defining the division of costs and responsibilities, this Incoterm helps both parties avoid misunderstandings in international logistics. In this article, we’ll explore the meaning of CFR, the roles of buyers and sellers, its advantages and limitations, and how it compares to similar terms like CIF.

What Is CFR Incoterm?

CFR (Cost and Freight) is one of the 11 Incoterms defined by the International Chamber of Commerce (ICC) to standardize global trade practices. Under the CFR Incoterm, the seller is responsible for arranging and paying the costs of transporting goods by sea to the destination port specified in the sales contract. However, once the goods are loaded on board the vessel, the risk of loss or damage shifts from the seller to the buyer.

This means that although the seller covers the freight cost, the buyer must handle all insurance, import customs clearance, and delivery beyond the arrival port. CFR applies only to maritime transport, making it a popular choice for bulk cargo shipments such as minerals, grains, and industrial materials.

In summary, CFR defines a clear division:

- Seller: Pays for transportation up to the destination port.

- Buyer: Assumes the risk once goods are shipped and covers all costs after arrival.

By understanding CFR correctly, both parties can manage their costs, risks, and logistics more efficiently, reducing potential disputes during international shipping.

The Role of CFR in International Trade

The CFR Incoterm (Cost and Freight) plays a vital role in facilitating smooth and predictable trade between buyers and sellers across different countries. By clearly defining who pays for what and when the risk transfers, CFR helps reduce misunderstandings that often arise in international shipping contracts.

In international trade, CFR is particularly valuable for bulk commodities such as coal, oil, grains, metals, and machinery goods typically shipped in large quantities by sea. It provides a balanced framework where the seller manages the main transport, ensuring the goods reach the destination port, while the buyer gains control once the shipment is on board.

For exporters, CFR offers control over the main leg of transportation, allowing them to negotiate better freight rates and ensure timely delivery. For importers, it provides transparency and predictability in shipping costs since the freight is already included in the purchase price.

Overall, the role of CFR in international trade is to create clarity, efficiency, and fairness between trading partners, especially in large-scale sea freight transactions where cost management and risk distribution are critical for success.

When to Use CFR Scope and Limitations?

The CFR Incoterm (Cost and Freight) is best suited for international sea or inland waterway transport, especially when goods are shipped in bulk or large volumes. It’s commonly used for commodities such as raw materials, grains, construction equipment, or industrial machinery where transport by vessel is the most economical option.

When to Use CFR

- When the seller has better access to shipping arrangements and can secure cost-effective freight rates.

- When the buyer prefers the seller to handle the main transportation while taking responsibility for insurance and import clearance.

- When both parties want a clear cost structure the freight charge is included in the goods’ price, giving the buyer predictable delivery costs to the destination port.

- For long-distance or high-volume trade routes, where shipping by sea is the most efficient method.

Limitations of CFR

- CFR is only valid for sea and inland waterway transport; it cannot be used for air, rail, or road shipments.

- The risk transfers earlier (once goods are loaded on the ship), which can be disadvantageous for buyers if damage occurs during transport.

- The seller is not responsible for insurance, so the buyer must arrange separate cargo insurance to protect their goods.

- It can sometimes create coordination issues at the destination port, especially if the buyer and seller use different logistics agents.

In short, CFR should be used when sea transport is required and both parties understand the risk transfer point clearly. When managed properly, it provides cost control and simplicity, but without proper coordination or insurance, it can expose buyers to financial risk.

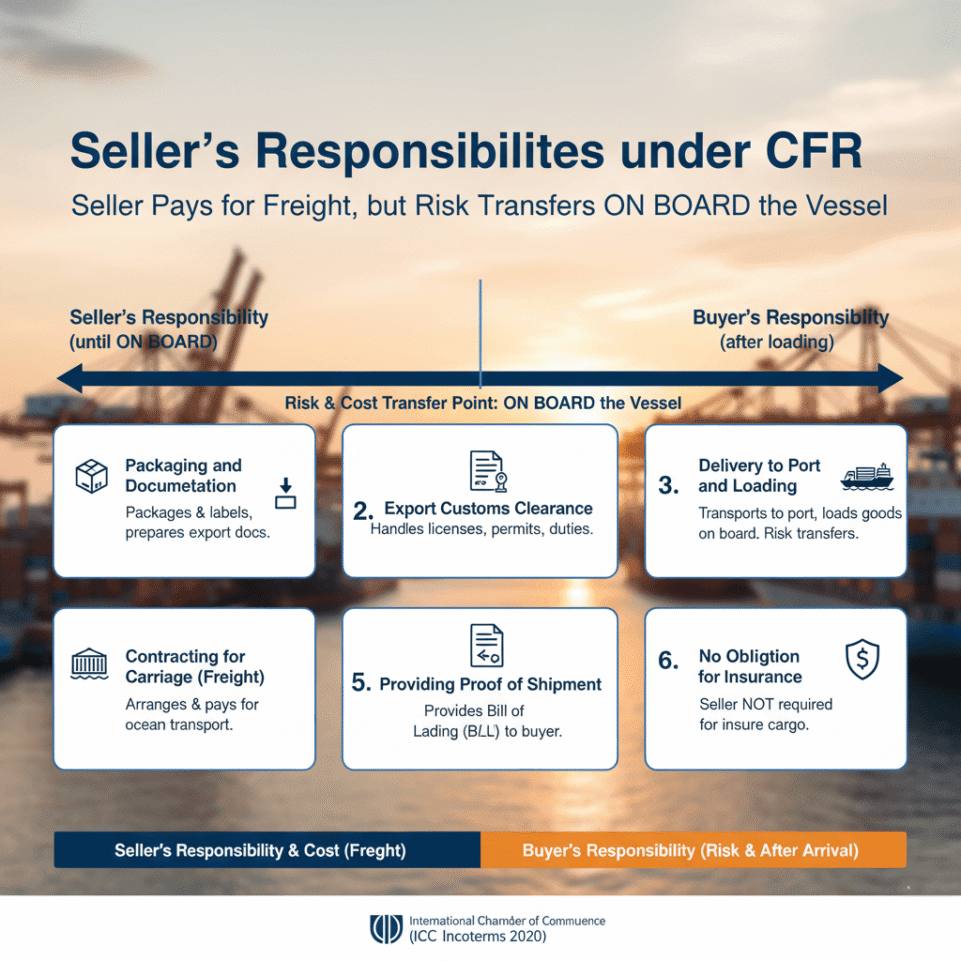

Seller’s Responsibilities under CFR

Under the CFR Incoterm (Cost and Freight), the seller plays a major role in managing and paying for the main transport of goods up to the destination port. However, the seller’s responsibility ends once the goods are safely loaded onto the vessel at the port of shipment. Below is a detailed breakdown of the seller’s duties:

1. Packaging and Documentation

The seller must properly package and label the goods according to export standards and prepare all necessary export documentation, including the commercial invoice, packing list, export licenses, and other regulatory certificates.

2. Export Customs Clearance

The seller is responsible for completing all export procedures, including obtaining export permits and paying any export duties or taxes required by the country of origin.

3. Delivery to Port and Loading

The seller must transport the goods to the designated port of shipment and ensure they are safely loaded on board the vessel chosen for the journey. At this point, the risk of loss or damage transfers to the buyer.

4. Contracting for Carriage (Freight)

One of the main seller obligations under CFR is to arrange and pay for the main carriage, meaning the ocean freight from the port of origin to the port of destination. The seller must select a vessel suitable for carrying the goods and ensure timely shipment.

5. Providing Proof of Shipment

The seller must provide the buyer with proof of shipment, such as the Bill of Lading, which serves as evidence that the goods have been shipped as agreed. This document is also essential for customs clearance and payment under letters of credit.

6. No Obligation for Insurance

Although the seller pays for freight, they are not required to provide cargo insurance under CFR. It is the buyer’s responsibility to insure the goods during transit if desired.

Buyer’s Responsibilities under CFR

Under the CFR Incoterm (Cost and Freight), the buyer takes over responsibility and risk once the goods are loaded onto the vessel at the port of shipment. Although the seller arranges and pays for the main freight, the buyer becomes liable for insurance, customs, and delivery after the goods have departed. Below is a clear outline of the buyer’s key obligations:

1. Payment for the Goods

The buyer must pay the agreed price for the goods as stated in the sales contract. This payment typically includes the cost of goods and the freight arranged by the seller, but excludes insurance and import-related expenses.

2. Risk After Shipment

Once the goods are on board the ship, all risks of loss or damage transfer from the seller to the buyer. The buyer must be prepared to handle any issues that occur during sea transport.

3. Import Customs Clearance

At the destination port, the buyer is responsible for customs clearance procedures, including preparing and submitting import documents, paying duties, taxes, and complying with local regulations.

4. Insurance Arrangement

Unlike CIF, under CFR the seller does not provide insurance. Therefore, it is the buyer’s duty to arrange appropriate cargo insurance to protect against potential loss or damage during transit.

5. Unloading and Onward Transport

The buyer must handle the unloading of goods at the destination port and manage all costs related to storage, inland transport, and final delivery to their warehouse or customer.

6. Coordination with Shipping Documents

The buyer must carefully review the Bill of Lading and other shipping documents provided by the seller to ensure they match the contract terms and facilitate the smooth release of goods from the carrier.

Transfer of Risk and Cost

One of the most important aspects of the CFR Incoterm (Cost and Freight) is understanding when and how the risk and cost are transferred between the seller and the buyer. These two elements risk and cost do not shift at the same time, which makes CFR different from many other Incoterms.

Transfer of Risk

The transfer of risk occurs once the goods are loaded onto the vessel at the port of shipment. From that moment, any loss, damage, or delay that happens during sea transport becomes the buyer’s responsibility. Even though the seller arranges and pays for the freight, the risk no longer belongs to them once the cargo is on board.

This early transfer of risk is a crucial point for buyers, as it means they must ensure proper insurance coverage for the goods during the sea journey.

Transfer of Cost

While the risk transfers at the port of origin, the cost transfer happens at a different stage. The seller must pay all costs related to exporting, delivering, and shipping the goods to the destination port including port handling and freight charges.

Once the goods reach the destination port, all additional costs (such as unloading, import duties, taxes, customs clearance, and inland transport) are paid by the buyer.

| Responsibility | Seller | Buyer |

|---|---|---|

| Export customs and documentation | Yes | No |

| Main freight to destination port | Yes | No |

| Cargo insurance | No | Yes |

| Risk during sea transport | No | Yes |

| Import clearance, duties, inland transport | No | Yes |

In essence, under CFR, the seller covers the cost of freight, but the buyer bears the risk after shipment. This separation makes it vital for both parties to understand their responsibilities clearly to avoid disputes and unexpected financial losses.

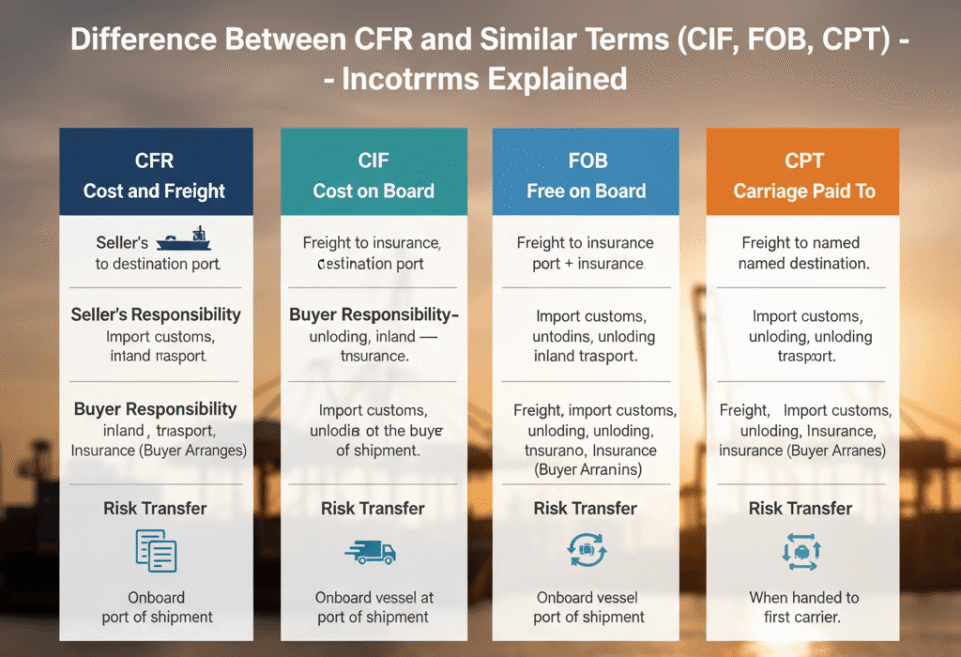

Difference Between CFR and Similar Terms (CIF, FOB, CPT)

Understanding the differences between CFR and other commonly used Incoterms is crucial for international trade. While CFR defines clear responsibilities for cost and risk, terms like CIF, FOB (Free On Board) , and CPT have their own variations that can affect logistics, cost, and insurance.

1. CFR vs CIF (Cost, Insurance, and Freight)

- CFR: The seller arranges and pays for the freight to the destination port, but does not provide insurance.

- CIF: The seller also provides cargo insurance, protecting the buyer against loss or damage during transit.

- Key Difference: Insurance coverage under CFR, the buyer must arrange insurance; under CIF , the seller includes it.

2. CFR vs FOB (Free on Board)

- CFR: Seller pays for freight to the destination port, but the risk transfers to the buyer once goods are on board the vessel.

- FOB: Seller’s responsibility ends at the port of shipment; the buyer pays for freight and bears the risk from that point.

- Key Difference: Freight cost under CFR, the seller pays for main transport; under FOB, the buyer pays.

3. CFR vs CPT (Carriage Paid To)

- CFR: Only applicable for maritime transport; risk transfers when goods are loaded onto the ship.

- CPT: Can be used for any mode of transport; the seller pays for carriage to a named destination, but risk transfers to the buyer at the point of delivery to the first carrier.

- Key Difference: Mode of transport and risk transfer point CFR is sea-only with risk at shipment,CPT is multimodal with risk at handover to the carrier.

| Incoterm | Seller’s Responsibility | Buyer’s Responsibility | Risk Transfer | Insurance | Mode of Transport |

|---|---|---|---|---|---|

| CFR (Cost and Freight) | Freight to destination port | Import customs, unloading, inland transport | Onboard vessel at port of shipment | Buyer arranges | Sea or inland waterway only |

| CIF (Cost, Insurance, and Freight) | Freight to destination port + insurance | Import customs, unloading, inland transport | Onboard vessel at port of shipment | Seller provides | Sea or inland waterway only |

| FOB (Free on Board) | Delivery on board vessel at port of shipment | Freight, import customs, unloading, inland transport | Onboard vessel at port of shipment | Buyer arranges | Sea or inland waterway only |

| CPT (Carriage Paid To) | Freight to named destination | Import customs, unloading, inland transport | When handed to first carrier | Buyer arranges | Any mode of transport (multimodal) |

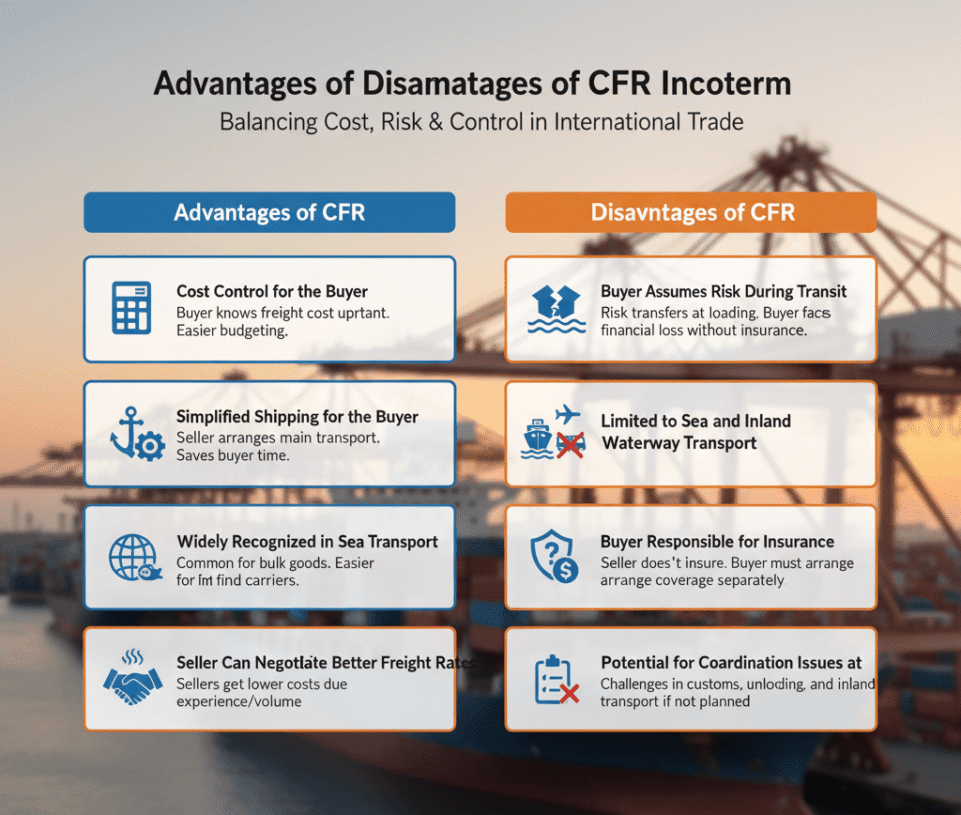

Advantages and Disadvantages of CFR

Understanding the advantages and disadvantages of CFR is crucial for both buyers and sellers to make informed decisions in international trade.

Advantages of CFR

Cost Control for the Buyer

The buyer knows the freight cost upfront because it is included in the price paid to the seller. This makes budgeting and cost planning easier.

Simplified Shipping for the Buyer

The seller arranges the main transport, saving the buyer time and effort in negotiating with shipping companies.

Widely Recognized in Sea Transport

CFR is a common Incoterm in maritime shipping, especially for bulk goods, making it easier to find carriers familiar with the terms.

Seller Can Negotiate Better Freight Rates

Sellers often have more experience and access to freight providers, which can result in lower overall shipping costs.

Disadvantages of CFR

Buyer Assumes Risk During Transit

Risk transfers to the buyer once goods are loaded on the vessel, even though the seller pays for freight. Without proper insurance, the buyer may face financial loss.

Limited to Sea and Inland Waterway Transport

CFR cannot be used for air fright , road, or rail shipments, which limits its flexibility for some buyers.

Buyer Responsible for Insurance

Unlike CIF, the seller is not obliged to provide insurance, so the buyer must arrange and pay for coverage separately.

Potential for Coordination Issues at Destination

The buyer may face challenges in customs clearance, unloading, and inland transport if not properly coordinated with local agents.

| Advantages | Disadvantages |

|---|---|

| Buyer knows freight cost upfront | Buyer assumes risk once goods are loaded |

| Seller arranges main transport, saving buyer effort | Limited to sea and inland waterway transport |

| Widely recognized in maritime shipping | Buyer responsible for insurance |

| Seller can negotiate better freight rates | Potential coordination issues at destination port |

Key Contract Considerations under CFR

When using CFR Incoterm (Cost and Freight) in international trade, both buyers and sellers must pay attention to certain contract details to avoid misunderstandings and financial risks.

1. Clearly Define Ports

The port of shipment and destination port must be clearly stated in the contract. Ambiguities can lead to disputes over responsibility for freight and risk.

2. Specify Delivery Terms

The contract should clearly indicate that the seller’s responsibility ends when goods are loaded on the vessel, while the buyer assumes risk thereafter. This helps prevent disagreements about damage during transit.

3. Freight and Cost Allocation

Although the seller pays for the freight to the destination port, the contract should outline who is responsible for additional charges, such as port handling, storage fees, or demurrage, if applicable.

4. Insurance Arrangements

Since CFR does not require the seller to provide insurance, the contract should specify that the buyer must arrange insurance for the goods in transit.

5. Documentation Requirements

The contract should detail the documents to be provided by the seller, including the Bill of Lading, commercial invoice, packing list, and export licenses. These documents are crucial for customs clearance and payment under letters of credit.

6. Terms of Payment

Payment terms should be clearly outlined, including whether the buyer pays upon shipment, upon receipt of documents, or using letters of credit. Clear payment terms help prevent disputes and delays.

Real-World Example (CFR Scenario in Sea Freight)

To better understand how CFR Incoterm (Cost and Freight) works in practice, let’s look at a real world shipping from China to the US scenario:

Scenario:

An American importer orders 10,000 kg of machinery parts from a manufacturer in China. The sales contract specifies CFR Los Angeles Port, USA.

Seller’s Responsibilities:

The Chinese manufacturer carefully packages the machinery and completes all export documentation required for shipping from China to the US.

They transport the goods to Shanghai Port, arrange for loading on a vessel, and pay the ocean freight to Los Angeles Port.

Once the goods are loaded on board, the seller’s responsibility ends under CFR terms.

Buyer’s Responsibilities:

From the moment the goods are on the vessel, the US buyer assumes all risk of loss or damage during transit.

The buyer arranges marine insurance to cover the sea voyage.

Upon arrival at Los Angeles Port, the buyer manages import customs clearance, unloading, and inland transport to their warehouse.

Any additional port handling or storage fees are also paid by the buyer.

Outcome:

- The seller fulfills their obligation by covering the main carriage cost and delivering the goods safely on board the vessel in China.

- The buyer, aware of their responsibilities under CFR shipping from China to the US, ensures proper insurance coverage and smooth customs procedures after arrival.

This example clearly illustrates how CFR shipping from China to the US divides costs and risks: the seller manages ocean freight, while the buyer takes responsibility after shipment and handles all post-arrival logistics.

Common Risks and How to Manage Them

Although CFR Incoterm (Cost and Freight) provides a clear framework for cost and responsibility, both buyers and sellers face certain risks during international shipping.

Understanding these risks and taking preventive measures is crucial.

1. Risk of Damage or Loss During Transit

- Description: Under CFR, the risk transfers to the buyer once goods are loaded onto the vessel. Any damage or loss during sea transport is the buyer’s responsibility.

- Management: Buyers should purchase cargo insurance covering the full value of goods and potential transit risks.

2. Delays at Destination Port

- Description: Unexpected port congestion, customs inspections, or labor strikes can delay unloading.

- Management: Both parties should plan buffer times in the contract and maintain communication with shipping agents to monitor vessel schedules.

3. Incorrect or Missing Documentation

- Description: Missing or inaccurate shipping documents can cause customs clearance problems and delays.

- Management: Sellers must prepare accurate documents (Bill of Lading, commercial invoice, packing list, export licenses), and buyers should verify them upon receipt.

4. Additional Costs at Destination

- Description: Charges such as port handling, storage fees, demurrage, or inland transportation are the buyer’s responsibility. Unexpected fees can increase costs.

- Management: Buyers should clarify potential charges in advance and budget accordingly.

5. Currency and Payment Risks

- Description: Fluctuations in currency or delays in payment can affect trade costs.

- Management: Parties should use secure payment methods, such as letters of credit, and define clear payment terms in the contract.

Summary and Recommendations

Summary:

- The CFR Incoterm (Cost and Freight) is a widely used international shipping term that defines clear responsibilities for both buyers and sellers in maritime trade. Under CFR:

- The seller arranges and pays for the main transport to the destination port and provides all necessary export documentation.

- The buyer assumes risk once the goods are loaded onto the vessel and is responsible for insurance, import customs clearance, unloading, and inland transportation.

- CFR is particularly suitable for bulk goods transported by sea, offering cost predictability and simplified shipping for the buyer while allowing the seller to manage freight efficiently.

Recommendations:

- Buyers should arrange cargo insurance to cover risks after the goods are loaded on the vessel.

- Clear contract terms should define ports, delivery terms, documentation, and payment responsibilities.

- Communication between parties is essential to avoid delays, misunderstandings, and unexpected costs at the destination port.

- Consider alternatives (CIF, FOB, CPT) if insurance coverage, mode of transport, or risk transfer points better suit your trading needs.

- Plan for additional costs such as port handling, storage fees, and inland transportation to prevent budget surprises.

By following these recommendations, both buyers and sellers can leverage the benefits of CFR while minimizing risks, ensuring smooth and successful international transactions.

Final Thoughts

Understanding the CFR Incoterm (Cost and Freight) is essential for anyone involved in international trade, especially those shipping goods by sea. This term strikes a balance between cost control for sellers and logistical responsibility for buyers. By clearly defining who pays for what and when the risk transfers CFR helps avoid confusion and disputes between trading partners. However, its effectiveness depends on proper planning, transparent communication, and accurate documentation throughout the shipping process.

Considering the Shipping Routes is crucial when applying CFR, as this Incoterm is primarily used for sea and inland waterway transport. Choosing the right Shipping Methods and routes ensures that freight costs are managed efficiently while risk transfers are clearly defined, allowing both sellers and buyers to plan logistics effectively.

For businesses seeking efficiency and predictability in maritime trade, CFR remains one of the most practical and reliable Incoterms. Still, both buyers and sellers should always evaluate their trade conditions, Shipping Methods, and routes, and when necessary, consider complementary terms such as CIF or FOB to ensure full protection and suitability.

FAQs: CFR incoterms

Which is better, CIF or CFR?

CIF is better if the buyer wants the seller to provide insurance; CFR is preferable if the buyer arranges their own insurance.

What is the difference between CFR and DDP?

CFR covers freight to the destination port, while DDP (Delivered Duty Paid) includes delivery to the buyer’s premises, with all duties and taxes paid by the seller.

What are the disadvantages of using CFR?

The buyer assumes risk once goods are loaded, must arrange insurance, and CFR is limited to sea/inland waterway transport.

Are CIF and CFR the same?

No, CIF includes insurance provided by the seller, while CFR does not.

How is CFR different from CIF?

CFR = seller pays freight, buyer arranges insurance; CIF = seller pays freight and insurance.

Is CIF a good choice for buyers?

Yes, especially if the buyer wants insurance included and prefers minimal risk during sea transport.

Is CFR only for sea freight?

Yes, CFR applies only to maritime and inland waterway shipments.

What does CFR mean?

CFR stands for Cost and Freight, meaning the seller pays for transport to the destination port, but risk transfers once goods are on board.

What does CFR mean in shipping?

It means the seller covers the cost of freight to the destination port, but risk transfers to the buyer once the goods are loaded.

What does CFR mean in trucking?

CFR is generally not used in trucking, as it is specific to sea and inland waterway transport.

Who pays freight for CFR?

The seller pays the freight to the destination port.

Who pays freight on CFR?

The seller is responsible for freight charges to the destination port.

Who pays freight in CFR Incoterm?

The seller pays for freight to the port of destination.

Who pays for freight under CIF?

The seller pays for freight and also provides insurance to the destination port.

Who pays for CFR?

The seller pays for the main freight to the destination port; the buyer assumes risk after loading.