Table of Contents

Introduction to CIF Incoterms in International Trade

CIF, which is one of the widely used Incoterms in international trade, simply outlines the responsibility of sellers and buyers in a shipping contract for clarity in worldwide transactions. In CIF, sellers bear the cost of the goods, freight charges, and minimum insurance up to their arrival at the port of destination. This term is mainly used for transporting goods by sea and inland waterways. With CIF, an enterprise has the advantage of much simpler logistics and fewer chances for disputes regarding who is taking care of what in that transaction, but buyers will need to be aware that any insurance being arranged by the sellers might include only minimal risk, therefore often requiring extended cover for the buyer depending on the good being traded. CIF instills confidence and guarantees smooth transactions in cross-border trade, hence it is widely preferred by exporters and importers alike.

Definition of CIF: Cost, Insurance, and Freight

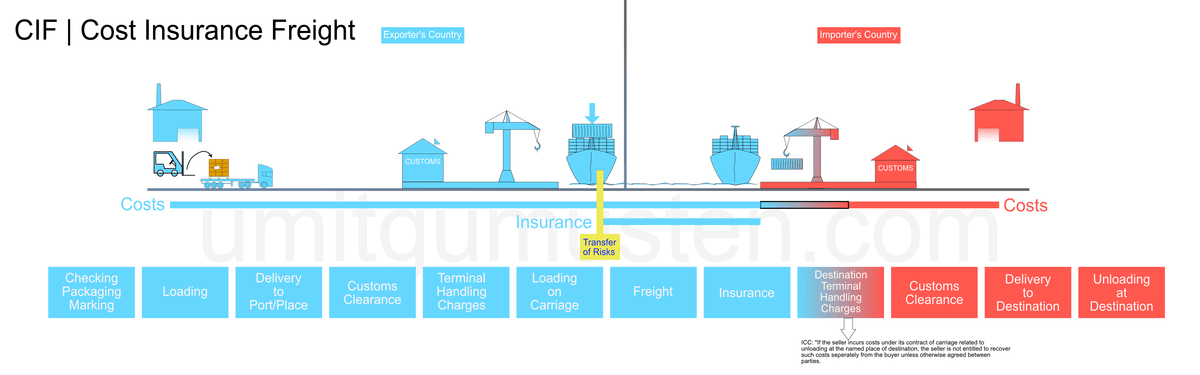

CIF is an abbreviation for Cost, Insurance, and Freight, a shipping term under Incoterms that defines the seller’s obligations in international trade. In a CIF agreement, the seller pays for the cost of goods, insurance, and freight to the destination port. This is helpful for buyers who would not want to deal with the initial shipping logistics themselves. Insurance is a very crucial thing in CIF, whereby the seller has to cover basically against any risks which could befall the shipment of goods during the period of transition; nonetheless, the buyer bears every risk once the goods arrive at the port, including customs clearances, unloading, and onward transport. CIF is quite practical for business enterprises involved in sea freight, as it provides a framework that ensures the seller undertakes key initial responsibilities while the buyer takes up the final delivery logistics.

CIF and the Allocation of Responsibilities between the Seller and the Buyer

CIF is thus a very important delimiter of how responsibility is divided between sellers and buyers under international trade. In this Incoterm, the seller holds very hefty initial responsibilities for the cost of the goods, transportation arrangement to the destination port, and the provision of insurance to cover the risks likely to be associated with the transit. This will ensure that at the point of arrival at the destination port, the buyer faces minimal hassle. While the goods arrive at the port, the buyer then assumes responsibility for customs clearance, unloading, and onward delivery to the final destination. This clear allocation of responsibilities helps reduce disputes and streamline shipping processes. CIF is particularly beneficial for buyers who are not experienced in international logistics, as the seller handles most of the initial coordination. For sellers, it allows them to retain control over shipping while transferring post-arrival risks to the buyer.

Buyers Obligation under CIF

Once a seller has satisfied their end, for example, having goods shipped to the destination port, paying for basic insurance for such transportation under the CIF Incoterm, the role of a buyer begins from this moment, starting at the time of unloading up until custom clearance. Key Responsibilities Of Buyers Under CIF Include

1. Taking delivery of goods arriving at the port of arrival

The buyer, upon the arrival of the goods at the named port, is obligated to make appropriate arrangements for delivery. This involves verification of the shipment’s documents, a bill of lading, to ensure that the goods are those as specified.

2. Pay for Unloading and Customs Clearances

The buyer has to pay for unloading expenses when the goods arrive at the port and ensure that all customs duty, taxes, and relevant documentation are completed. Payments and other formalities must be dealt with in a timely manner to avoid delays or any fines.

3. Managing Risks After Goods Are Loaded onto the Ship

Whereas the seller covers the goods with basic insurance against transit, from the time the goods are shipped, the buyer bears the full risk for the goods. The buyer must consider any extra insurance required because of the loss or damage that could happen during transport or post-arrival unloading.

The Role of Port of Origin and Port of Destination

The ports of export and import are significant to the process of international shipment, and as provided for under the Incoterms, especially by the CIF, where the roles of buyers and sellers are defined. The two critical points are the port of origin and the port of destination, serving distinct purposes in the chain of shipping.

Port of Origin: The Handover Point to the Freight Carrier

The port of origin is the place where the seller delivers the goods to the freight carrier. Up to this point, the seller ensures that the goods are properly packaged, loaded, and ready for transportation. The seller also assumes all costs arising during this phase, including loading charges and export customs formalities. While this marks the beginning of the journey, and therefore the beginning of all the risks, for the buyer, the risks continue to lie with the seller until the goods are actually on board the vessel.

Port of Destination: Where the Buck Stops for the Seller

The port of destination is the point at which the seller’s cost responsibilities, under CIF, come to an end. The seller pays transportation, freight, and basic insurance up to this port. Once the goods arrive, the buyer assumes responsibility for unloading, customs clearance, and further transportation. To buyers, the port of destination is important because it is from this point that they have direct control over the shipment, including the risks and expenses involved.

Insurance in CIF: An Overview

Insurance forms a very important component of the CIF agreement in safeguarding against potential losses or damages during the transportation of goods. It provides financial security for both buyers and sellers, thus building trust and enabling smoother international trade.

1. Seller’s Insurance Requirements

CIF requires the seller to obtain minimum insurance to cover the goods in transit to the destination port. The requirement, in this regard, ensures that the buyer is protected from certain risks, which include damage or loss while transportation. However, it normally provides only basic cover, like total loss, and excludes a broader risk of partial damage or theft.

2. Scope and Coverage of Insurance en Route

The insurance provided by the seller, as a rule, extends to cover from the port of origin to the port of arrival. It contains such risks as accidents, cataclysms, or other sudden and unexpected events. Purchasers should examine the terms of the policy and consider extended insurance against additional risks of full loss or damage, in particular, valuable or sensitive items.

3. Functions of the Insurance Company, Protecting the Buyer’s Interests

An insurance company plays a pivotal role in managing the claims in case of loss or damage during transit. Although the seller arranges the policy, the buyer may benefit from it since the claim processes are reimbursements for risks covered. Insurance terms have to be carefully evaluated by the buyer to ensure protection against adequate risks affecting shipment.

Risk Transfer under CIF Terms

Risk transfer is a very important aspect of the CIF terms, whereby the responsibilities of the buyer and seller are directly affected. In CIF, the point at which the risk of loss or damage to the goods passes from the seller to the buyer is clearly stated, thus making international trade agreements transparent.

1. When the Risk Transfers from Seller to Buyer

Under CIF terms, the risk passes from the seller to the buyer when goods are loaded onto the ship at the port of origin. That means that any incidents during sea transport, such as damage or loss, are the buyer’s responsibility, even though the seller has arranged for basic insurance coverage. Consequently, while the seller is responsible for transportation and insurance, the buyer has to be ready to deal with all possible risks from the moment when the goods are on board.

2. Influence of the Risk Transfer on Buyer’s Means of Risk Management

The risk transfer considerably influences the buyer’s attitude towards risk management. Since the buyer takes the in-transit risk, a buyer should pay great attention to the insurance provided by a seller to make sure it meets all his expectations. Buyers usually go for added insurance that covers the risks not provided in the basic policy. Also, understanding the point of risk transfer helps the buyer prepare in case any financial liabilities arise and also ensure safe arrival.

Role of the Freight Carrier under CIF

The freight carrier is the most crucial in CIF agreements for ensuring the safe and timely transportation of goods from the port of origin to the port of destination. The seller, in a CIF term, is mainly responsible for choosing a reliable carrier that can undertake the shipping obligation of the seller.

1. Seller’s Responsibility to Choose a Reliable Freight Carrier

Under CIF, the seller would have to select a line of freight that is reasonably capable of carrying the goods effectively and safely. A good carrier also means the shipment quality might be maintained without any time delays or other mishaps. The freight forwarder should be experienced, with recommended certifications and facilities to handle the goods appropriately. A good carrier not only secures the shipment but also builds up a sense of trust between the buyer and the seller.

2. Importance of Reduction of Risks in Transportation

The freight carrier’s efficiency has a direct effect on the risk management process in CIF. While the seller is required to provide basic insurance, it is of essence for the buyer’s interest that the transportation risks are at their minimum. This includes handling, storage, and delivery on time. A freight carrier that is reliable will reduce instances of damage, loss, or delays, making the shipping process smoother and more predictable for all parties concerned.

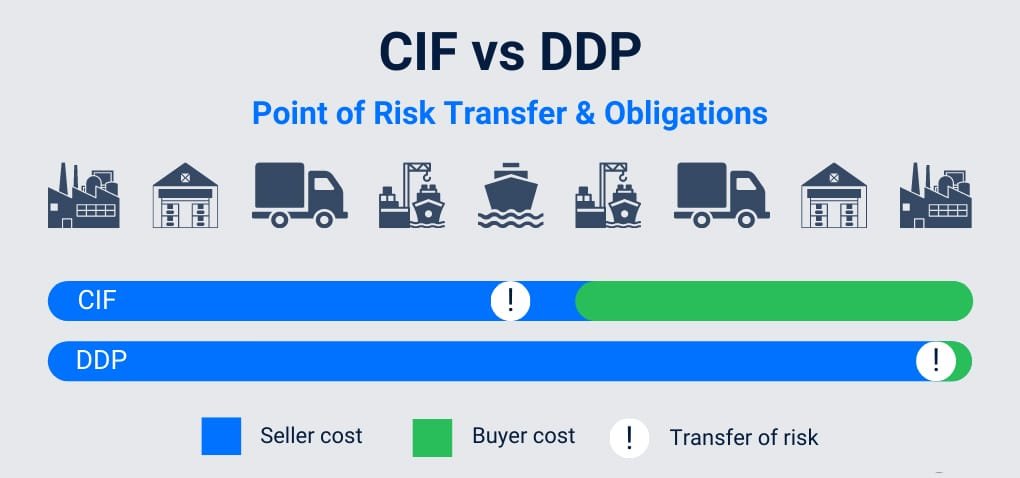

Differences between CIF and Other Incoterms

1. CIF versus FOB (Free on Board)

Under FOB, the seller’s liability stops when the goods are loaded onto the ship at the port of origin. Unlike CIF, FOB does not require the seller to arrange insurance or pay for freight. All transportation and risks after loading fall completely on the buyer.

2. CIF vs. EXW (Ex Works)

EXW places the least responsibility on the seller, whereby the latter only has to present the goods ready for collection at his premises. The buyer assumes all responsibilities of transport, insurance, and risks from the seller’s premises to the final destination. On the contrary, CIF requires the seller to bear costs and risks until the arrival of the goods at the port of destination.

3. CIF vs. DAP (Delivered at Place)

Under DAP, the seller delivers the goods to the buyer’s location, bearing all costs and risks of delivery. While CIF ends the responsibility of the seller at the destination port, DAP extends it to the point of final delivery.

These subtle differences emphasize the shared cost and risk of CIF, making it practical in maritime trade.

Advantages and Disadvantages of Using CIF

CIF – Cost, Insurance, and Freight – has a few advantages and disadvantages for buyers and sellers. Understanding them would help parties decide if this is what they need for the trade and how to handle challenges accordingly.

1. Benefits of CIF for Sellers and Buyers

For Sellers:

CIF simplifies the process by allowing sellers to retain control over transportation and insurance arrangements until the goods reach the destination port. This builds trust with buyers and demonstrates accountability.

For Buyers:

Buyers benefit from reduced logistical responsibilities, as the seller handles freight and insurance. This is particularly advantageous for those unfamiliar with shipping processes or lacking access to reliable carriers.

2. Common Challenges and How to Manage Them

Basic Insurance Coverage:

CIF requires the seller to provide only minimal insurance, which might not be enough to cover all of the buyer’s risks. The buyer should, therefore, review the policy and arrange additional coverage if necessary.

Higher Costs:

CIF can lead to higher overall costs for buyers since the seller may include premiums for arranging freight and insurance. Buyers can negotiate terms or compare alternative Incoterms to ensure cost efficiency.

Limited Buyer Control:

Since the seller is responsible for choosing the carrier and insurer, buyers may have very limited influence in these areas. In this regard, the problem may be mitigated through clear communication and the setting of expectations with the seller.

CIF represents a very good option for balanced risk sharing but needs careful planning regarding its limitations.

The standard meaning of CIF is a highly used Incoterm: “Cost, Insurance, and Freight” defines both buyers’ and sellers’ respective positions in international trade. A perfectIncoterm in the perspective of maritime shipping, through which freight and insurance are managed with convenience for buyers by a seller.

CIF instills confidence in the seller by proving responsibility and ensuring that the merchandise arrives at the destination port. Buyers enjoy less logistical hassle; however, they have to keep their eyes open regarding insurance coverage and where the risk passes to avoid any surprising liabilities.

The best use of CIF is when both parties value clarity, risk management, and efficiency in their collaboration. Full understanding of CIF terms and limits provides a sound basis for business decisions, thus contributing to easier and more reliable international trade.

TopShipping

With years of experience in logistics and freight forwarding, the author is passionate about making shipping smoother and more efficient.

As a leader at TopShipping, they’ve developed a deep understanding of supply chain management, international shipping rules, and creative logistics solutions. They’re driven by a desire to help businesses succeed by delivering reliable, customer-focused services.

Over the years, they’ve also shared their expertise by writing for various industry publications, offering practical tips and insights on the latest trends in logistics. Thanks to their leadership, TopShipping has become a trusted name for companies looking for hassle-free global freight solutions.

Comment Section