Introduction

In international trade, DDP (Delivered Duty Paid) is one of the most comprehensive Incoterms, placing maximum responsibility on the seller. Under DDP shipping terms, the seller manages every stage of the shipment from export documentation and freight to import clearance, customs duties, and local taxes.

This makes DDP an attractive option for buyers who want a hassle-free delivery process. However, for sellers, it requires a deep understanding of the buyer’s country’s import laws, as unexpected duties or local taxes can significantly affect profitability.

In this article, we’ll explain DDP meaning in shipping, break down seller and buyer obligations, explore cost and duty implications, and compare DDP vs DAP to help you choose the right term for your international trade deals.

What Is DDP? Delivered Duty Paid Meaning

Delivered Duty Paid (DDP) is an international shipping term defined by the Incoterms rules issued by the International Chamber of Commerce (ICC), which clearly outlines the responsibilities of the buyer and seller during global trade. Under DDP shipping terms, the seller is responsible for delivering the goods to the buyer’s specified location, covering all costs and risks involved in the process — from export clearance and freight charges to import duties, taxes, and customs formalities.

In other words, DDP means “door-to-door delivery” where the seller manages every stage of transportation until the goods reach the buyer’s premises. The buyer, therefore, doesn’t need to handle shipping arrangements, customs paperwork, or any extra charges after purchase.

Established by the International Chamber of Commerce, the DDP Incoterm provides maximum assurance for buyers while placing the heaviest responsibility on the seller, who must be fully aware of the import regulations and tax systems in the destination country to ensure smooth delivery.

DDP Incoterms 2020: Key Updates and Rules

| Category | Seller’s Responsibility | Buyer’s Responsibility |

|---|---|---|

| Delivery Point | Deliver goods at the named place in the buyer’s country, ready for unloading. | Receive and unload goods (unless otherwise agreed). |

| Risk Transfer | Bear risk until the goods are ready for unloading at the named place. | Assume risk after delivery at the named place. |

| Transport | Arrange and pay for all transport stages (export, main carriage, import, delivery). | No transport arrangements required. |

| Customs Duties & Formalities | Handle and pay for all export and import customs formalities, duties, taxes, and required permits. | Cooperate and provide any documents or information the seller needs for import formalities. |

| Insurance | Not required by DDP by default; recommended for seller’s protection if seller chooses. | May obtain additional insurance if desired. |

| Documentation | Provide commercial invoice, transport documents, and any permits or certificates needed for import. | Receive documents and use them to take delivery or for local compliance as needed. |

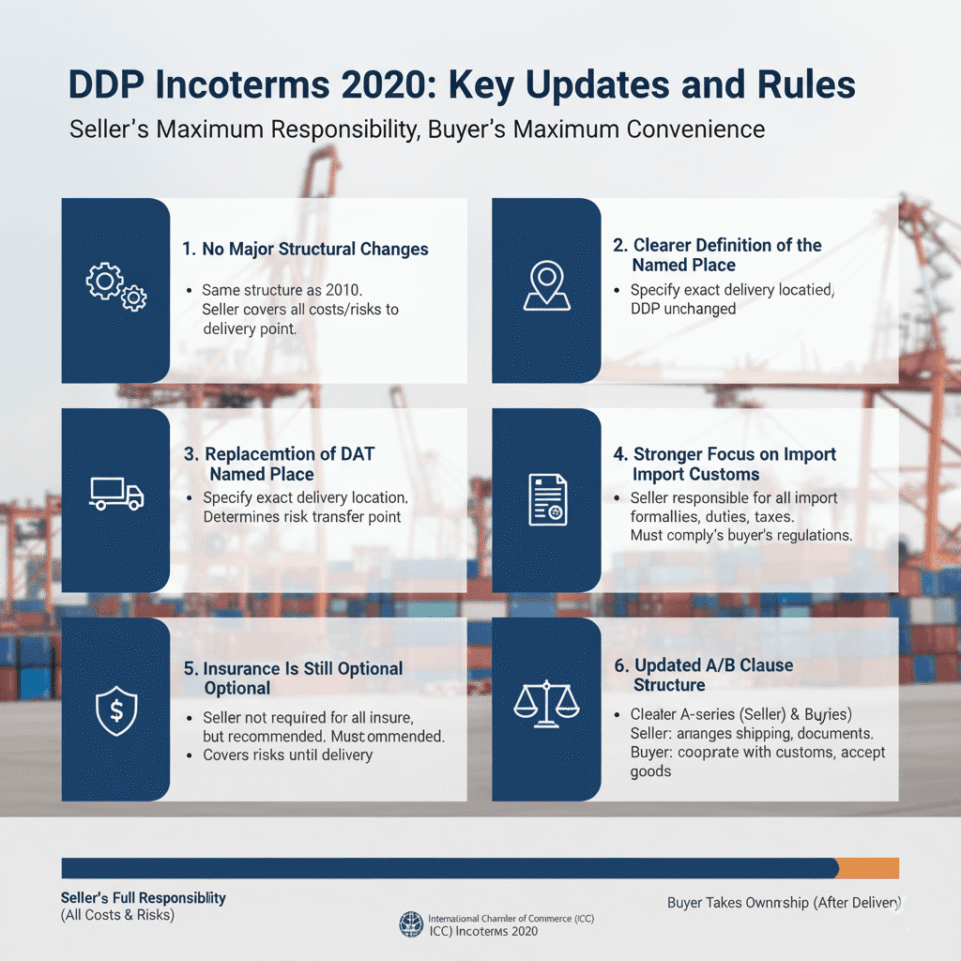

Under the Incoterms® 2020, the Delivered Duty Paid (DDP) term remains one of the most comprehensive and buyer-friendly trade rules. While the core definition hasn’t changed since the 2010 version, there are several important clarifications and updates that affect how DDP should be applied in modern international trade.

1. No Major Structural Changes

DDP under Incoterms 2020 keeps the same structure as in 2010. The seller is still responsible for delivering the goods to the buyer’s country, including payment of all transportation costs, import duties, and taxes. However, the 2020 edition places stronger emphasis on clearly defining responsibilities in the sales contract.

2. Clearer Definition of the Named Place

The 2020 update highlights the importance of specifying the exact delivery location (named place). This determines the point at which risk transfers from seller to buyer. Without a clear location, misunderstandings and disputes may arise regarding who bears responsibility for delays or damages.

3. Replacement of DAT with DPU

Although this change does not directly affect DDP, the 2020 version replaced the DAT (Delivered at Terminal) term with DPU (Delivered at Place Unloaded). This reflects a broader effort to make delivery terms clearer and more flexible across all Incoterms rules.

4. Stronger Focus on Import Customs Obligations

In DDP, the seller remains fully responsible for all export and import customs formalities, including paying duties, taxes, and obtaining necessary permits. Incoterms 2020 emphasizes that the seller must be aware of and comply with the import regulations of the buyer’s country, or risk delays and penalties.

5. Insurance Is Still Optional

As in previous versions, DDP does not require the seller to provide cargo insurance. However, since the seller bears all risks until delivery at the buyer’s location, it is often recommended that the seller arranges insurance to protect against loss or damage in transit.

6. Updated A/B Clause Structure

Incoterms 2020 provides clearer separation between the A-series (seller obligations) and B-series (buyer obligations).

Under DDP:

- The seller must handle all shipping arrangements, export/import procedures, and provide required delivery documents.

- The buyer must cooperate with customs formalities if needed and accept the goods once delivered.

Seller’s Responsibilities under DDP

Under Delivered Duty Paid (DDP) Incoterms, the seller holds the maximum responsibility for ensuring the goods reach the buyer’s final destination. The seller manages every stage of the process from production and export clearance to import duties and final delivery — making DDP the most seller-intensive shipping term.

Preparing and Packing the Goods

The seller is responsible for manufacturing, packaging, and labeling the goods according to international transport standards. All products must be securely packed to withstand long-distance handling and shipment.

Export Documentation and Customs Clearance

Before shipping, the seller must obtain all necessary export licenses, prepare required documents (such as invoices, packing lists, and certificates of origin), and complete export customs procedures in their own country.

Arranging International Transportation

The seller organizes and pays for the main transportation from the point of origin to the buyer’s country. This can include sea freight, air freight, rail, or road transport, depending on the agreed method and destination.

Insurance Coverage (Optional)

Although not mandatory, many sellers include insurance under DDP to protect against damage or loss during transit, since the seller carries the full risk until the goods are delivered to the buyer’s location.

Import Customs and Duties

A major distinction of DDP is that the seller must handle all import-related procedures in the buyer’s country. This includes:

Import licenses and permits

Customs documentation

Payment of import duties, VAT, GST, and other local taxes

This step ensures the goods are fully cleared before delivery.

Inland Delivery to the Final Destination

After customs clearance, the seller arranges local transportation within the buyer’s country to deliver the goods to the agreed location — typically the buyer’s warehouse, office, or another specified address.

Risk and Delivery Completion

Under DDP, the risk transfers from the seller to the buyer only after the goods have been delivered to the agreed destination and are ready for unloading. The unloading itself is usually the buyer’s responsibility unless otherwise stated in the contract.

DDP Seller Cost and Pricing Structure

Because DDP covers every step until delivery, the seller must carefully calculate all related expenses to set a realistic and profitable price.

Key Cost Components:

- Product Cost :Covers production, packaging, labeling, and export preparation.

- Export Fees :Includes documentation, inspection, and customs clearance costs in the seller’s country.

- Freight Charges :The main transport cost for moving goods internationally by air, sea, or land.

- Insurance (if included) :Optional protection against loss or damage during shipment.

- Import Duties and Taxes :All customs tariffs, VAT, and service fees payable in the buyer’s country.

- Domestic Delivery Costs :Covers inland transport within the destination country to the final delivery point.

- Administrative and Handling Fees :Expenses related to customs brokers, documentation, logistics coordination, and compliance.

DDP Pricing Formula

DDP Price = Product Cost + Export Fees + Freight + Insurance (if any) + Import Duties/Taxes + Local Delivery + Administrative Costs

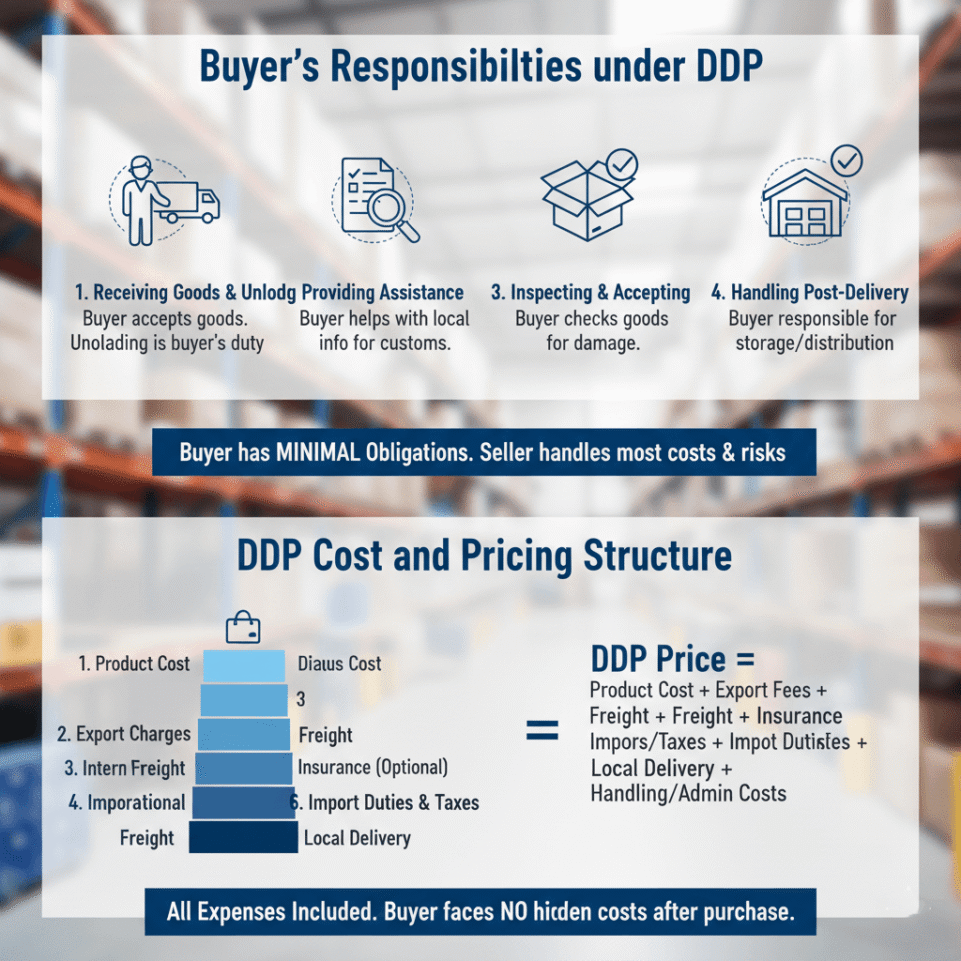

Buyer’s Responsibilities under DDP

Under Delivered Duty Paid (DDP) terms, the buyer has minimal obligations compared to the seller, as most costs and risks are handled by the seller. However, there are still a few key responsibilities the buyer must fulfill to ensure smooth delivery and acceptance of goods.

Receiving Goods and Unloading

The buyer must be available to receive the goods at the agreed location once they arrive.

Although the seller is responsible for transportation and import clearance, the unloading process at the destination is typically the buyer’s duty unless both parties agree otherwise in the contract.

Providing Assistance for Import Procedures

While the seller handles import duties and paperwork, the buyer may need to supply local information, documents, or authorizations required for customs clearance in their country.

Inspecting and Accepting Delivery

After the goods are delivered, the buyer should inspect them for any visible damage or shortages and confirm receipt according to the purchase agreement.

Handling Post-Delivery Obligations

Once delivery is completed, the risk transfers to the buyer. From that point, the buyer is responsible for the storage, distribution, or resale of the goods within the destination country.

DDP Cost and Pricing Structure

Under Delivered Duty Paid (DDP) terms, the seller carries the full financial responsibility of moving goods from their location to the buyer’s destination. The DDP price represents the total landed cost, meaning all expenses are included until the goods are delivered and ready for unloading.

Here’s how DDP costs are calculated and what they include:

Product Cost

The base price of the goods, including production, packaging, labeling, and preparation for export.

Export Charges

Fees for export documentation, licenses, inspections, and export customs clearance in the seller’s country.

International Freight

The cost of transporting the goods from the seller’s country to the buyer’s country, whether by air, sea, or land.

Insurance (Optional)

Although not mandatory, sellers often include insurance in DDP pricing to cover potential loss or damage during shipment.

Import Duties and Taxes

One of the biggest cost components. The seller must pay all import customs duties, VAT, GST, and clearance fees in the buyer’s country.

Domestic Delivery (at Destination)

After customs clearance, the seller pays for local inland transportation to deliver the goods to the buyer’s specified address.

Administrative and Handling Fees

Costs related to managing paperwork, customs brokers, logistics coordination, and compliance with import regulations.

DDP Price Formula

DDP Price = Product Cost + Export Fees + Freight + Insurance (if any) + Import Duties/Taxes + Local Delivery + Handling/Admin Costs

Because the DDP price includes every expense up to delivery, the buyer faces no hidden or additional costs after purchase.

This makes DDP ideal for buyers who prefer simplicity and predictable pricing, while requiring sellers to carefully calculate and manage all related charges to maintain profitability.

DDP Incoterms Duties and Taxes Explained

Under Delivered Duty Paid (DDP) terms, the seller is responsible for all import-related fees in the buyer’s country. This is one of the key features that makes DDP highly convenient for buyers but places significant responsibility on sellers. Here’s a detailed breakdown of the fees sellers must cover at import customs:

1. Import Duties

Sellers must pay any customs duties or tariffs imposed on the goods upon arrival in the buyer’s country. These rates vary depending on the type of product, its origin, and the country’s tariff schedule.

2. Value-Added Tax (VAT) or Goods and Services Tax (GST)

Most countries charge VAT or GST on imported goods, calculated as a percentage of the total landed cost (product price + shipping + duties). The seller must remit these taxes to customs before delivery.

3. Customs Clearance Fees

These include charges levied by the customs authority for processing import paperwork, inspecting goods, and ensuring regulatory compliance.

4. Other Government Fees or Excise Taxes

Some products may be subject to special excise taxes, environmental fees, or other government-imposed levies. Sellers must research and pay these as part of the DDP obligations.

5. Broker or Agent Fees

While optional, many sellers hire a customs broker to handle documentation and payments efficiently. Fees for this service are part of the DDP cost structure.

DDP Incoterms Transport and Insurance Terms

Under Delivered Duty Paid (DDP) Incoterms, the seller is responsible for arranging and paying for all transportation from their location to the buyer’s specified destination. This includes every stage of the shipment, whether by land, sea, or air, covering both international freight and local delivery at the buyer’s premises.

Transport Responsibilities

- Main Carriage :The seller contracts and pays for the international shipping of goods to the buyer’s country.

- Inland Transportation :The seller also arranges transport from the port of arrival or border to the buyer’s final location.

- Logistics Coordination :The seller must manage all transit documents, shipping schedules, and delivery arrangements to ensure goods arrive on time.

Insurance

- Not mandatory under DDP: The Incoterms rules do not require the seller to provide cargo insurance.

- Optional but recommended: Since the seller bears the risk until delivery at the named place, obtaining insurance protects against loss, damage, or theft during transit.

- Buyer insurance: The buyer may also choose to purchase additional insurance once the goods arrive, especially for high-value or sensitive items.

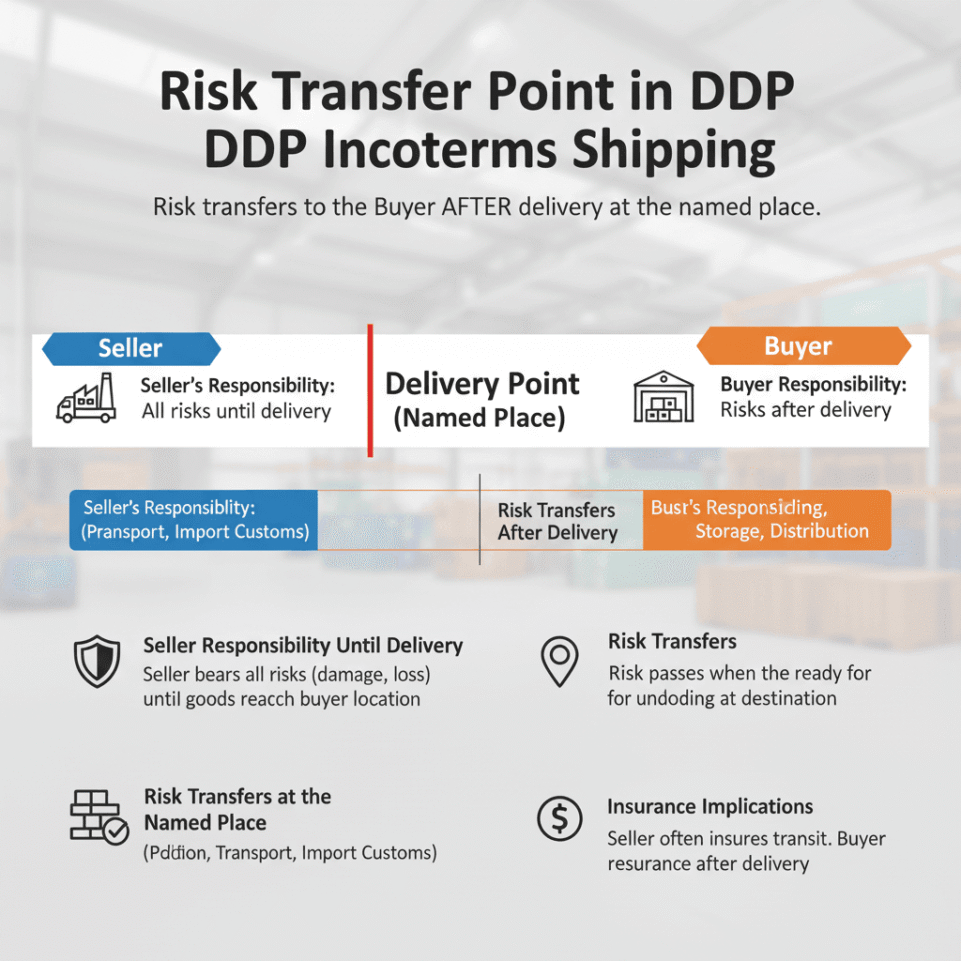

Risk Transfer Point in DDP Incoterms Shipping

In Delivered Duty Paid (DDP) terms, the transfer of risk from seller to buyer occurs at the agreed delivery location in the buyer’s country, typically when the goods are made available for unloading. This is a key feature of DDP that distinguishes it from other Incoterms.

Key Points about Risk Transfer under DDP

- Seller’s Responsibility Until Delivery :The seller bears all risks associated with the goods including damage, loss, or theft from the moment the goods leave their premises until they reach the buyer’s location.

- Risk Transfers at the Named Place :The risk passes only when the goods are ready for unloading at the agreed destination.

- If unloading is the buyer’s responsibility, the seller’s risk ends before unloading begins.

- Implications for Insurance :Because the seller carries risk throughout transit, it is often recommended to arrange insurance to cover potential losses or damages during transport.

- Buyer’s Responsibility After Delivery :Once the goods are delivered and ready for unloading, the buyer assumes all risks. From this point forward, the buyer is responsible for storage, handling, or onward distribution.

DDP vs DAP: What’s the Difference?

| Feature | DDP (Delivered Duty Paid) | DAP (Delivered at Place) |

|---|---|---|

| Costs Covered | All transport, duties, taxes, customs, delivery | Transport to destination; buyer pays import duties/taxes |

| Risk Transfer | At destination, ready for unloading | At destination, before import clearance |

| Customs Handling | Seller handles both export and import | Seller handles export; buyer handles import |

| Buyer Convenience | High; minimal involvement | Moderate; buyer manages customs and taxes |

| Seller Responsibility | Maximum; full cost and risk | Lower; no import duty/tax liability |

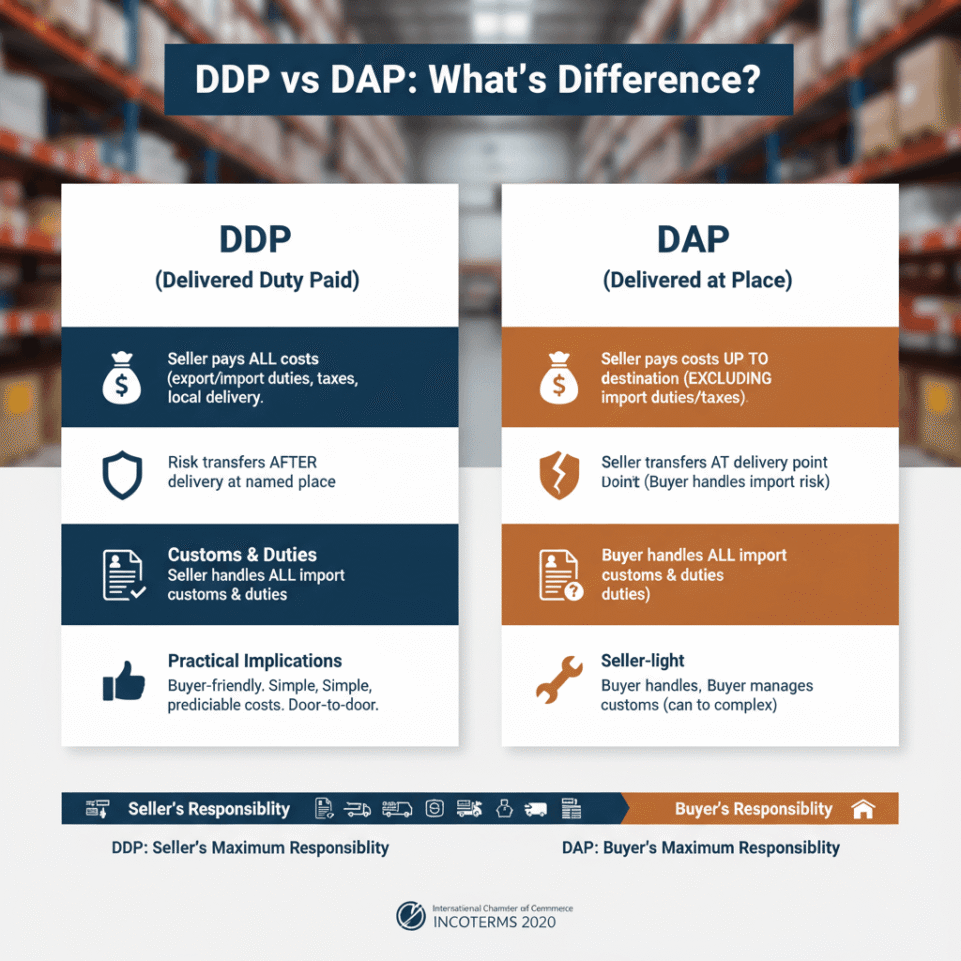

While both Delivered Duty Paid (DDP) and Delivered at Place (DAP Incoterms) are common Incoterms for international trade, they differ significantly in cost allocation, responsibilities, and customs handling. Understanding these differences helps buyers and sellers choose the right shipping terms for their transactions.

1. Cost Responsibility

- DDP: The seller pays all costs involved in delivering the goods to the buyer’s location, including export and import duties, taxes, and local delivery charges. The buyer pays nothing beyond the purchase price.

- DAP: The seller covers costs up to the agreed delivery location, excluding import duties and taxes. The buyer is responsible for customs clearance and paying import duties, which can lead to unexpected costs if not properly planned.

2. Risk Transfer

- DDP: Risk transfers from seller to buyer only when the goods are delivered and ready for unloading at the named place in the buyer’s country. The seller carries all transit risks until that point.

- DAP: Risk also transfers at the named delivery point, but the buyer bears any risk or responsibility associated with import clearance and taxes.

3. Customs and Duties

- DDP: The seller handles all customs formalities, including payment of import duties and taxes. Buyers do not deal with customs unless agreed otherwise.

- DAP: The seller does not pay import duties or taxes. The buyer must handle import customs clearance and pay any associated fees.

4. Practical Implications

- DDP is buyer-friendly: simple, predictable costs, minimal logistics involvement, and a “door-to-door” solution. However, it places heavy responsibility on the seller.

- DAP is seller-light: sellers avoid import taxes and duties but buyers must manage customs, which can be complex or delay delivery.

DDP Incoterms Comparison: DAP vs DDU

| Feature | DDP | DAP | DDU |

|---|---|---|---|

| Costs Covered | All costs including duties, taxes, customs, transport | Transport to destination; buyer pays import duties/taxes | Transport to destination; buyer pays import duties/taxes |

| Risk Transfer | At buyer’s location, ready for unloading | At buyer’s location, before import clearance | At buyer’s location, before import clearance |

| Customs Handling | Seller handles all export and import | Seller handles export; buyer handles import | Seller handles export; buyer handles import |

| Buyer Convenience | High | Moderate | Moderate |

| Seller Responsibility | Maximum | Medium | Medium-Low |

Understanding the differences between DDP (Delivered Duty Paid), DAP (Delivered at Place), and DDU (Delivered Duty Unpaid) is essential for international trade, as each term affects cost allocation, risk, and customs responsibilities.

1. Delivered at Place (DAP)

- Seller Responsibility: The seller delivers goods to the agreed destination but does not pay import duties or taxes.

- Buyer Responsibility: The buyer is responsible for import customs clearance and payment of duties and taxes.

- Risk Transfer: Occurs at the named delivery location, before import customs.

- Best For: Sellers who want to minimize exposure to import duties and buyers who are willing to handle local import procedures.

2. Delivered Duty Unpaid (DDU)

- Seller Responsibility: The seller delivers goods to the buyer’s country without paying import duties or taxes. The seller may handle transport to the destination but does not clear customs.

- Buyer Responsibility: Responsible for import duties, taxes, and customs clearance.

- Risk Transfer: Occurs when goods reach the buyer’s location, similar to DAP.

- Best For: Sellers who want to avoid import obligations entirely and buyers familiar with customs procedures.

3. Delivered Duty Paid (DDP)

- Seller Responsibility: The seller bears full responsibility for costs, risk, and customs, including import duties, taxes, and delivery to the agreed destination.

- Buyer Responsibility: Minimal; only responsible for receiving and unloading the goods.

- Risk Transfer: Occurs at the named place of delivery once goods are ready for unloading.

- Best For: Buyers seeking turnkey delivery with predictable costs and minimal logistics involvement.

DDP vs CIF and FOB: Which Is Better for You?

| Feature | DDP | CIF | FOB |

|---|---|---|---|

| Cost Responsibility | Seller pays all costs to buyer’s location | Seller pays to port of destination; buyer pays import and local costs | Buyer pays most costs after goods are onboard ship |

| Risk Transfer | At buyer’s location, ready for unloading | At ship’s rail at origin port | At ship’s rail at origin port |

| Customs Clearance | Seller handles all export and import | Buyer handles import | Buyer handles import |

| Buyer Convenience | High; minimal involvement | Moderate; buyer manages import and local delivery | Low; buyer manages shipping and import |

| Seller Responsibility | Maximum | Medium; covers shipping and minimal insurance | Minimal after loading onto ship |

Choosing the right Incoterm depends on how much responsibility, cost, and risk you are willing to take as a buyer or seller. Delivered Duty Paid (DDP), Cost, Insurance, and Freight (CIF), and Free on Board (FOB) are three commonly used terms, but they differ significantly in pricing, risk, and logistics responsibilities.

1. DDP (Delivered Duty Paid)

- Seller Responsibility: Maximum seller handles all costs, transport, import duties, taxes, and customs clearance until the goods arrive at the buyer’s location.

- Buyer Responsibility: Minimal buyer only receives and unloads the goods.

- Best For: Buyers who want a hassle free, predictable landed cost and minimal involvement in logistics or customs.

2. CIF (Cost, Insurance, and Freight)

- Seller Responsibility: The seller arranges and pays for shipping to the port of destination and provides minimum insurance coverage.

- Buyer Responsibility: Takes over risk once goods pass the ship’s rail at the port of origin, and is responsible for import clearance, duties, and local delivery.

- Best For: Buyers who can manage customs and inland logistics in the destination country and want lower upfront costs.

3. FOB (Free on Board)

- Seller Responsibility: The seller delivers goods onboard the ship at the port of shipment. After loading, risk transfers to the buyer.

- Buyer Responsibility: Responsible for main carriage, insurance, import clearance, and local delivery.

- Best For: Buyers who want full control over shipping and insurance and can handle international logistics efficiently.

Advantages & Disadvantages of DDP Shipping

Delivered Duty Paid (DDP) is one of the most buyer-friendly Incoterms, offering a “door-to-door” service where the seller handles nearly all aspects of transportation and customs. However, like any trade term, it has both advantages and disadvantages depending on your role in the transaction.

Advantages of DDP Shipping

- Buyer Convenience :The buyer faces minimal logistics responsibility, as the seller handles transport, import duties, taxes, and customs clearance.

- Predictable Costs :Since all expenses are included in the DDP price, the buyer knows the total landed cost upfront, reducing the risk of unexpected charges.

- Simplified Customs Process :The seller manages all import procedures, including paperwork and payments, making DDP ideal for buyers unfamiliar with the destination country’s regulations.

- Risk Management for Buyers :The seller bears all risks during transport until the goods reach the buyer’s location, protecting the buyer from losses or damages in transit.

- Time-Saving :Buyers save time and administrative effort, as they do not need to coordinate shipping, customs clearance, or inland delivery.

Disadvantages of DDP Shipping

- Higher Costs for Buyers :While convenient, the DDP price is usually higher than other Incoterms because the seller includes all duties, taxes, insurance, and logistics fees.

- Seller Responsibility Is High :Sellers bear maximum risk and cost, including unknown or fluctuating import duties, taxes, and regulatory fees.

- Complex Compliance for Sellers :Sellers must understand and comply with import regulations in the buyer’s country, which can be complicated and vary widely.

- Limited Flexibility for Buyers :Buyers have little control over shipping routes, carriers, or timing, as these are handled by the seller.

- Potential Delays if Seller Mismanages Import Procedures :Any errors or delays in customs clearance by the seller can impact delivery time, which may frustrate buyers despite the DDP promise.

Common Mistakes When Using DDP Incoterms

While Delivered Duty Paid (DDP) provides maximum convenience for buyers, it can create challenges for sellers and lead to costly errors if not managed carefully. Here are some of the most common mistakes businesses make when using DDP:

1. Underestimating Import Duties and Taxes

Sellers sometimes miscalculate import duties, VAT, or other taxes in the buyer’s country. This can lead to unexpected costs, reduced profit margins, or delayed deliveries.

2. Failing to Understand Local Regulations

Every country has unique customs rules, documentation requirements, and restrictions. Ignoring these can result in customs fines, confiscation, or shipment delays.

3. Not Clearly Specifying the Delivery Location

DDP requires a named place of delivery. Vague instructions can cause disputes over when risk transfers, who unloads the goods, or where exactly delivery occurs.

4. Omitting Insurance

Although insurance is optional under DDP, many sellers fail to arrange adequate coverage, leaving them exposed to loss or damage during transit.

5. Miscommunication with Buyers

Buyers may assume all aspects of delivery are handled, but unclear communication about responsibilities like unloading or additional local handling can cause conflicts.

6. Ignoring Currency Fluctuations

Sellers who pay import duties in the buyer’s local currency may face additional costs due to exchange rate changes if not planned for in advance.

7. Overcomplicating Logistics

Since DDP involves multiple stages export, international freight, import clearance, and domestic delivery poor planning or inadequate logistics management can lead to delays and increased costs.

Practical Example / Case Study of DDP Shipping

Let’s consider a real-world scenario to understand how Delivered Duty Paid (DDP) works in shipping from China to the US, including costs, responsibilities, and risk transfer.

Scenario

A company in Shenzhen, China is selling electronic gadgets to a buyer in Los Angeles, USA under DDP Incoterms 2020.

Order Details:

- Product cost: $10,000

- Quantity: 100 gadgets

- Weight: 500 kg

Step 1: Seller Costs

| Cost Component | Amount (USD) | Notes |

|---|---|---|

| Product Cost | 10,000 | Manufacturing and packaging |

| Export Customs Fees | 200 | Export documentation and clearance in China |

| International Freight | 1,200 | Ocean or air freight from Shenzhen to Los Angeles |

| Insurance | 150 | Optional cargo insurance during transit |

| Import Duties & Taxes | 1,500 | US import duties and customs clearance fees |

| Local Delivery in the US | 300 | Truck delivery to buyer’s warehouse in Los Angeles |

| Total Seller Cost | 13,350 | Total DDP price |

The Chinese seller quotes $13,350 DDP, which includes all costs for shipping from China to the US — from factory in Shenzhen to the buyer’s warehouse in Los Angeles.

Step 2: Buyer Costs

- Under DDP shipping from China to the US:

- The buyer pays nothing extra for customs, duties, or delivery.

- The buyer only receives and unloads the goods at the agreed location.

Step 3: Risk Transfer

- The seller bears all risks and responsibilities until the goods are delivered to the buyer’s warehouse in the US.

- Once the goods arrive and are ready for unloading, risk transfers to the buyer.

Step 4: Benefits and Implications

Buyer:

- Receives goods hassle-free, with predictable and transparent total cost ($13,350).

- Doesn’t need to handle customs clearance or logistics.

Seller:

- Manages all shipping, customs, and delivery arrangements under DDP shipping from China to the US.

- Must be familiar with US import regulations, taxes, and compliance requirements to ensure smooth delivery.

Final Word

Delivered Duty Paid (DDP) is one of the most buyer-friendly Incoterms, offering a hassle-free, all-inclusive delivery solution. By placing full responsibility for transportation, customs duties, taxes, and risk on the seller, it ensures buyers enjoy predictable costs and minimal logistical involvement.

However, DDP also requires careful planning and management from sellers, including accurate cost calculation, compliance with import regulations, and risk mitigation. When used correctly, DDP simplifies international trade, making it an ideal choice for buyers seeking convenience, while offering sellers an opportunity to provide premium, full-service delivery.

In summary, DDP is best suited for buyers prioritizing simplicity and certainty, and for sellers capable of handling the full scope of responsibilities efficiently.

FAQ DDP Incoterms

How does DDP differ from DDU?

DDU (Delivered Duty Unpaid) is similar to DDP, but under DDU, the buyer is responsible for import duties, taxes, and customs clearance. DDP, in contrast, includes all these costs in the seller’s responsibilities, making it more convenient for buyers.

Who arranges transport under DDP?

The seller arranges and pays for all transportation, including international freight and local delivery to the buyer’s location.

When should I use DDP shipping?

DDP is ideal when the buyer wants a turnkey, all-inclusive solution with predictable costs, and the seller is capable of handling all logistics, import regulations, and duties efficiently.